“The Most Important Chart in the World”

By Justin Spittler, editor, Casey Daily Dispatch

Do you own U.S. stocks? If so, you have to see this…

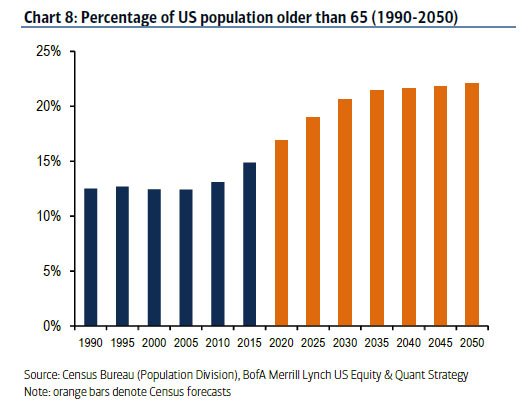

The chart below doesn’t show a stock, a commodity, or even a high-flying cryptocurrency.

Instead, it depicts an unstoppable trend that most investors have never even thought about. See for yourself.

You’re looking at the percentage of people living in the United States who are 65 years of age or older.

You can see that the number of seniors in the United States is about to explode.

This may not seem like a big deal to the casual observer. But it’s going to have profound investment implications.

Don’t just take my word for it, though.

• Two weeks ago, Raoul Pal called this “the single most important chart in the world”…

That’s a bold statement. But Pal knows what he’s talking about.

He used to run hedge fund sales at Goldman Sachs. He later comanaged the GLG Global Macro Fund, one of the world’s biggest hedge funds.

Pal made so much money by the age of 36 that he stopped managing outside money in 2004. But he didn’t completely retire.

Today, Pal writes the Global Macro Investor newsletter, one of the world’s most exclusive investment newsletters. His readers include hedge fund managers, sovereign wealth funds, and pension funds.

In short, Pal is one of the world’s top “big picture” thinkers. It pays to listen to him.

• So, I started researching U.S. demographics immediately after I saw this…

And it didn’t take me long to realize something…

Pal isn’t the only big-league investor who thinks this is a big deal.

Bill Gross is also deeply concerned about America’s aging population.

Gross is one of the world’s leading bond experts. He used to run PIMCO, one of the world’s largest money managers. Today, he manages about $1.9 billion at Janus Capital.

In January, Gross said demographics would likely “dominate investment markets and returns for the next few decades until the Boomer phenomena fades away.”

• Mark Yusko is deeply concerned about America’s aging population, too…

Yusko is another Wall Street legend. He manages $1.6 billion at Morgan Creek Capital.

Like Pal and Gross, Yusko thinks demographics will drive stock performance for years to come…and not in a good way.

He thinks bad demographics will be one of three “killer D’s” facing the U.S. economy. The other two “D’s” are debt and deflation, which are another way of saying slow economic growth.

• These are some of the smartest investors on the planet…

They didn’t climb to the top of Wall Street by thinking like other investors. They got there by being original thinkers.

And yet, they’re worried about the same thing: America’s aging population.

Of course, they have good reason to be.

• Just look at what happened to Japan…

Japan’s population exploded after World War II.

This triggered a huge economic boom. It became one of the world’s most advanced economies.

Then, everything came undone in the early ‘90s.

Japan’s economy imploded and entered a vicious downturn.

Times were tough. So, many Japanese people stopped having children. And that’s left huge scars on its society.

• Last year was the eighth year in a row that Japan’s population shrank…

It was also the first time on record that less than 1 million babies were born in Japan. Meanwhile, the number of deaths in Japan hit a record high of 1.3 million.

Japan’s rapidly aging population is killing its economy.

Just look at this chart. It shows Japan’s annual economic output over the last two decades.

You can see that Japan’s economy has barely grown. It’s only 1% bigger than it was in 1997.

• Bad demographics have also plagued Japan’s stock market…

You can see what I mean below.

This chart shows the performance of the Nikkei 225, Japan’s version of the S&P 500, since 1997.

The Nikkei is up just 4% over this period.

In other words, Japanese stocks have been “dead money” for the past two decades.

• Now, the United States is about to get stung by the aging-population bug…

By 2030, more than 20% of the U.S. population will be at least 65 years old. That’s up from about 15% today.

By 2050, the U.S. will have twice as many seniors as it does today.

And many of these people will retire. They’ll stop producing for the economy.

They’ll also buy fewer godos and services. That’s what happens when people retire. Seniors spend about 38% less on consumer goods and services than people in the workforce.

That’s a serious problema.

After all, consumption makes up 70% of the U.S. economy. So, the economy could take a major hit if millions of people start buying fewer goods and services. If that happens, U.S. stocks could come crashing down, too.

• Just to be clear, I’m not saying the U.S. will become the next Japan…

But demographics in the U.S. are certainly getting worse. There’s no denying that.

And there’s nothing the government can do to stop it. The trend is in motion.

The good news is that there’s still time to prepare. Here’s what you can do today…

Lighten up on U.S. stocks. Now, I’m not saying you should hit the panic button. But now is a good time to reduce your exposure to U.S. stock holdings.

You can start by trimming your stake in risky U.S. stocks. You should also allocate less money to U.S. stocks going forward.

Move some money abroad. Focus on countries with improving demographics. That means countries with young and growing populations. Here are three countries that check those boxes…

• India

• Vietnam

• Indonesia

If you take these steps today, you’ll be miles ahead of most investors.

0 comments:

Publicar un comentario