China Slows Again: Hedge Your Growth Bets, But Don’t Panic

It’s getting harder to argue that weak numbers in July were just a heat-related fluke

By Nathaniel Taplin

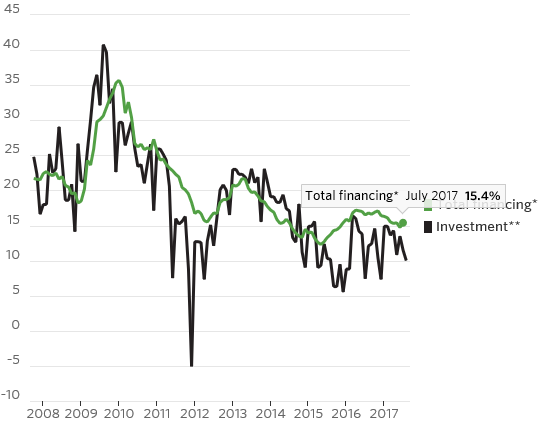

LOOKING DROOPY

Chinese data, change from a year earlier

One month of weak data could be a fluke—China’s record-high July temperatures led many to attribute the underperformance to a heat wave. Two in a row is harder to dismiss.

After a strong first half that confounded economists’ predictions of slower growth, China is now clearly downshifting. August industrial production was the weakest since December, while investment growth in the year to date hit its lowest level since 1999, according to official figures.

That followed July data that widely undershot expectations.

Slower credit growth following Beijing’s high-profile campaign against financial excesses earlier in the year, which pushed bond yields sharply higher, is finally beginning to bite.

In one sense this is a welcome development: The biggest slowdown last month was in infrastructure investment, which ticked down to 11% growth year over year from nearly 16% in July. Infrastructure projects of dubious merit are arguably the biggest source of China’s bad debt problem. More than half of all new liabilities at state-owned firms built up between 2007 and 2015, some 40 trillion yuan ($6 trillion), were infrastructure- and public-service related according to Andrew Batson, China Research Director at Gavekal Dragonomics. Many of those projects are uneconomic and now spend their time weighing down bank balance sheets rather than contributing to growth.

The problem is that Chinese infrastructure is a huge driver of both domestic industry and demand for materials world-wide.

In line with slowing investment growth, most key Chinese industrial indicators moved lower last month: Steel output slowed while cement production dropped outright on the year, falling at its fastest rate since 2015. Electricity production growth nearly halved, while coal power output dropped from 10.5% growth in July to just 3.5% in August. Numbers like that will likely put a damper on recent rallies in iron ore and coal.

STEEL YOURSELF

Chinese data, change from a year earlier

While this all sounds unpleasant, there are a few reasons for guarded optimism. First, real-estate investment in August ticked up again to 7.8% growth from the same time a year ago, reversing its drop to just 4.8% in July. The July figure was the lowest in a year and a bearish signal on the single most important sector for Chinese growth and commodity demand. Second, credit growth picked up again in July, in a sign that policy makers are also concerned that investment is now slowing too quickly.

With debt servicing costs at coal and steel plants still high, China’s economic mandarins are unlikely to permit an overly sharp slowdown in investment that could tank commodity markets, particularly right ahead of the twice-a-decade Communist Party leadership shuffle kicking off in mid-October.

China is slowing again, which means the giddy part of the global commodities—and associated reflation trades—is likely over. It isn’t time to run for the hills yet, but now would be a good time to start taking profits.

0 comments:

Publicar un comentario