ANOTHER NOBLE MESS -- THIS TIME, IT´S DERIVATIVES / THE WALL STREET JOURNAL

Another Noble Mess—This Time, It’s Derivatives

A dispute over credit default swaps written on the embattled commodity trader’s debt is exposing the limitations of the system governing such products

By Anjani Trivedi

Noble has suffered a grim couple of years, with earnings slumping and its market value diving amid questions over its accounting. Photo: Bobby Yip/Reuters

When things go wrong, insurance policies are supposed to pay out. In the case of Singapore-listed Noble Group, a once-prominent commodity trader that has fallen on hard times, that process is proving complicated.

Noble has suffered a grim couple of years, with earnings slumping and its market value diving amid questions over its accounting. Still, it managed to roll over billions of dollars worth of debt earlier this year, and has also persuaded its bankers to extend its credit lines.

But should these deals by Noble to extend its debt repayments be counted as a “credit event”?

That’s the question now being debated by those who bought and sold derivative products designed to insure investors against any default by Noble on its bonds. Such so-called credit default swaps were among the complex instruments that helped exacerbate the 2008 global financial crisis, when a sudden surge in bad debts landed sellers of such protection with large bills.

In recent months, hedge funds and other investors have been selling CDS on Noble’s debt, in effect betting that it wouldn’t default. As of late July, over $1 billion of CDS had been written on Noble’s debt with almost $160 million potentially owed to buyers, according to data from International Swaps and Derivatives Association, the industry body that standardized CDS contracts.

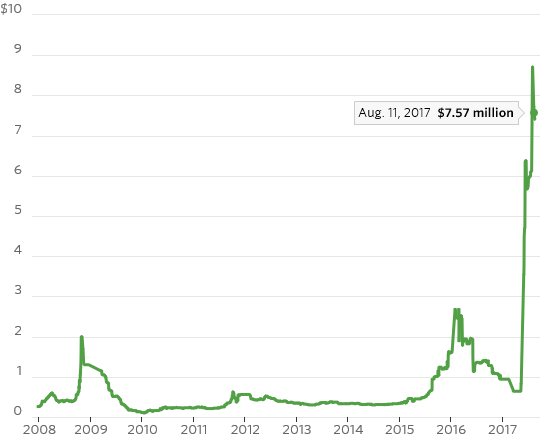

NOT SO NOBLE

Annual cost to insure $10 million of Noble´s debt against default for 10 years

As banks and investors—among them Goldman Sachs , Deutsche Bank and J.P. Morgan —who bought this protection lose ever more confidence in Noble, they are arguing its debt extensions should trigger payouts: Several have served so-called credit event notices recently.

Enter ISDA again: Since the financial crisis, it has been charged with adjudicating on whether credit events have occurred—a system designed to ensure fair and swift resolution of cases like Noble’s.

Except that ISDA has so far equivocated. Earlier this month it said it didn’t have enough information to determine whether Noble’s recent deals represent a credit event, and couldn’t get hold of the underlying documentation it needed “despite several efforts to do so.”

To be fair, Noble’s situation isn’t clear-cut. The company says it’s looking for “strategic alternatives”—code for seeking investors. Propped up by its lenders, the company has remained on life support, despite consistently negative cash flows.

But the Noble affair has exposed the limitations of the current resolution system for disputes over CDS. If ISDA’s adjudicating committee—which is due to meet again Tuesday to discuss the situation—fails to make a decision again, buyers of Noble CDS will be unable to get sellers to pay up. The fact that the committee comprises lawyers that are often from banks and investors with a financial interest in Noble’s CDS leaves it open to criticism from both sides.

ISDA should make a decision one way or the other, if only to avoid looking useless. The reality, though, is that this situation could end up in the courts—hardly a great advert for the much-maligned credit default swap.

0 comments:

Publicar un comentario