Apr. 2, 2015 1:52 AM ET

By Sumit Roy

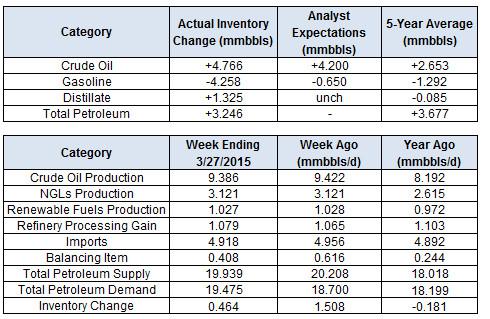

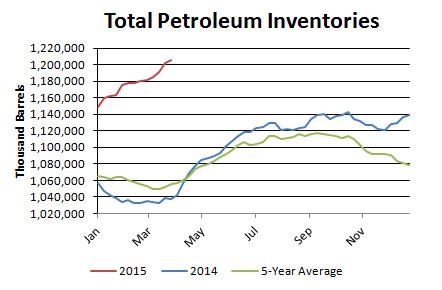

The Department of Energy reported Wednesday that in the week ending March 27, U.S. crude oil inventories increased by 4.8 million barrels, gasoline inventories decreased by 4.3 million barrels, distillate inventories increased by 1.3 million barrels and total petroleum inventories increased by 3.2 million barrels.

Crude oil was trading higher after the release of the latest inventory figures. While crude inventories rose significantly once again, the big decline in gasoline stockpiles offset that, leading to a neutral inventory report overall.

For oil, "neutral" is a big step up from the relentlessly bearish inventory figures that have come out in past weeks. Thus, it's not surprising to see prices rally on this report.

WTI may be poised to test the $50 mark, while Brent makes its way into the upper $50s.

BRENT

WTI

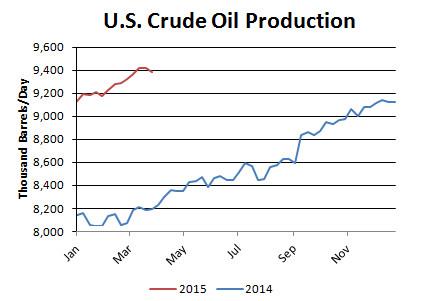

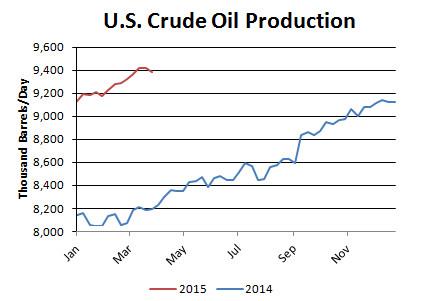

Whether this rally is sustainable or not depends on whether supply has truly tightened. In addition to the smaller build seen in inventories, the EIA reported that U.S. crude oil production declined to 9.39 mmbbl/d last week, down 36,0000 mmbbl/d from the multi-decade high set the previous week.

Declining U.S. output is something that many have been anticipating for some time now and is a key factor in any bullish oil prices thesis. That said, one week does not make a trend, and we've seen similar declines in the past. If output continues decreasing in the coming weeks, the market will take notice and send prices decisively above $50 for WTI and $60 for Brent.

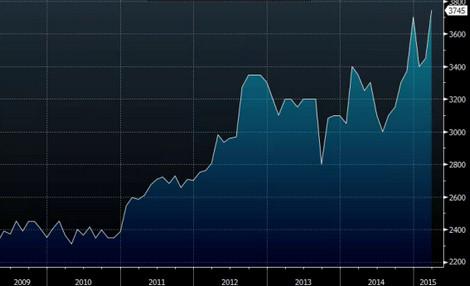

Meanwhile, as U.S. production faltered last week, output in OPEC countries went the other way. According to the latest survey from Bloomberg, OPEC production topped 31 million barrels per day in March, 1 million barrels per day above the group's quota and the highest level since 2013.

OPEC Crude Oil Production

Within OPEC, Iraq led the charge as output hit a record high near 3.75 million barrels per day.

Iraq Oil Production

OPEC's output would get a further boost if world powers and Iran are able to come to a successful resolution to the ongoing nuclear talks. Thus far, a deal has alluded negotiators, but if one comes to fruition and sanctions are lifted, Iranian crude oil exports could increase by upward of 1 million barrels per day down the line.

Turning to this week's EIA inventory figures, total petroleum inventories in the U.S. increased by 3.2 mmbbl, against the five-year average of a 3.7 mmbbl increase. In turn, the inventory surplus decreased to 149.3 mmbbl, or 14.1 percent, against the five-year average.

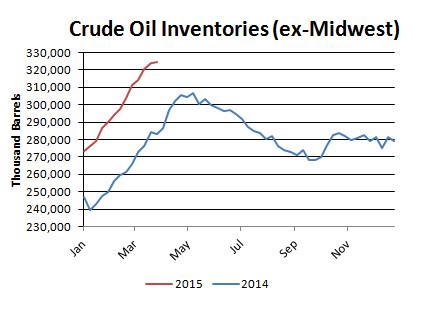

Crude oil inventories rose by 4.8 mmbbl, against the five-year average of a 2.7 mmbbl increase. In turn, the surplus in the crude category widened to 102.5 mmbbl, or 27.8 percent.

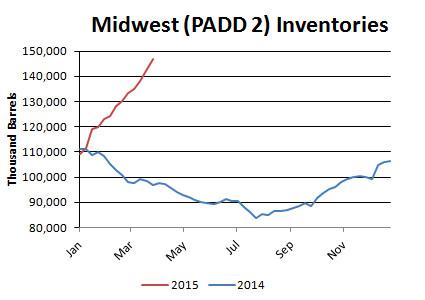

Regionally, inventories inside and outside the Midwest rose.

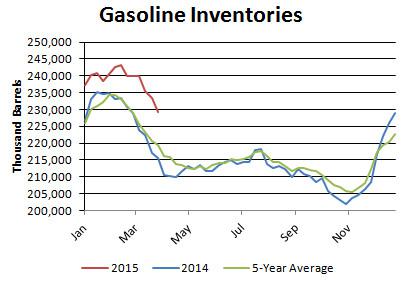

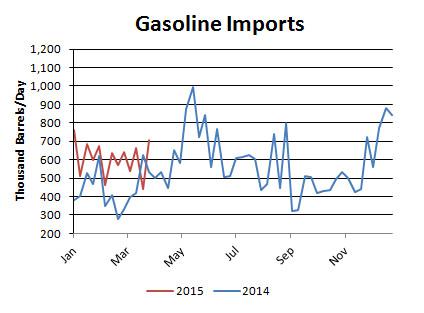

Gasoline inventories fell by 4.3 mmbbl against the five-year average of a 1.3 mmbbl decrease.

Gasoline inventories now have a surplus of 9.7 mmbbl, or 4.4 percent. Distillate rose by 1.3 mmbbl against the five-year average of a 0.1 mmbbl decrease. In turn, the distillate deficit narrowed to 5 mmbbl, or 3.8 percent.

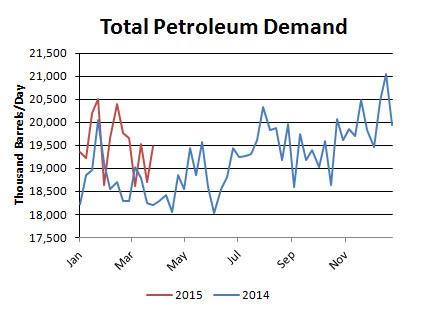

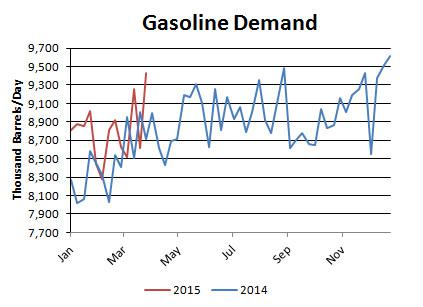

Demand

Total petroleum demand in the U.S. jumped to 19.5 mmbbl/d, while gasoline demand climbed to 9.5 mmbbl/d and distillate demand fell to 3.8 mmbbl/d. On a four-week rolling basis, total demand was up by 2.7 percent from last year. On that same basis, gasoline demand was up 1.9 percent and distillate demand was up by 1.3 percent.

It's worth noting that these figures may be overstated due to the EIA's methodology for calculating demand.

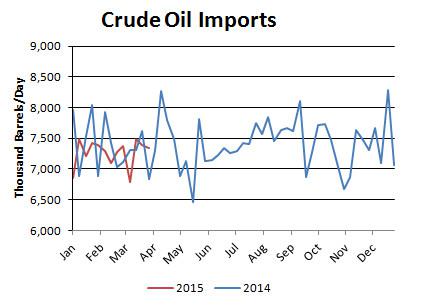

Imports

Crude oil imports fell fractionally to 7.3 mmbbl/d. On a four-week rolling basis, imports have averaged 0.1 percent below the year-ago level.

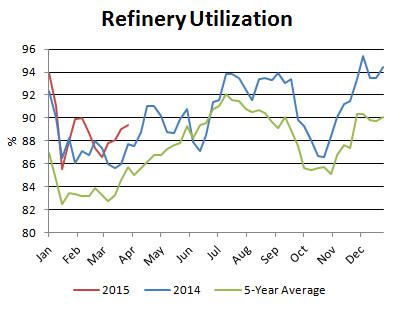

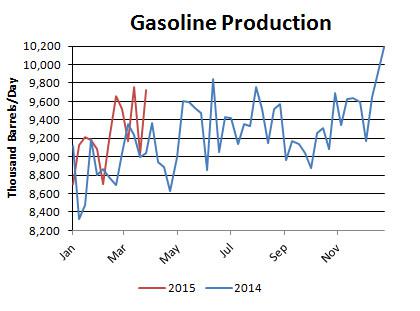

Refinery Activity

Refinery utilization ticked up from 89 percent to 89.4 percent. Utilization is above the year-ago level and above the five-year average. Gasoline production surged to 9.7 mmbbl/d, while distillate production edged rose to 4.9 mmbbl/d.

Miscellaneous

U.S. crude oil production declined to 9.39 mmbbl/d, down 36,0000 mmbbl/d from the multi-decade high set the previous week. Output has been rising swiftly due to surging production in unconventional oil plays. Since the start of the year, output has averaged 1.2 mmbbl/d, or 14.2 percent, above the same period a year ago.

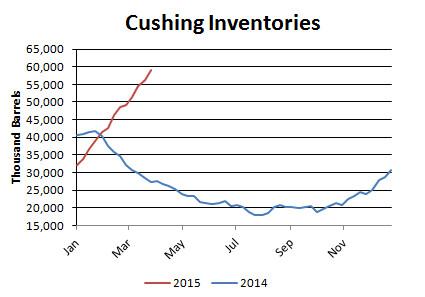

Inventories at the Nymex delivery point in Cushing, Oklahoma, rose by 2.6 million barrels to 58.9 million barrels, or 69.4 percent of the EIA's estimate of capacity. Overall, Midwest inventories rose by 4.3 million barrels to 147 million barrels, or 89 percent of estimated storage capacity.

Front-month WTI calendar spreads remained in contango at +$1.74.

Front-month Brent calendar spreads remained in contango at +$1.10.

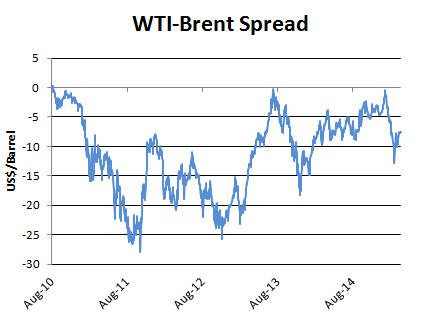

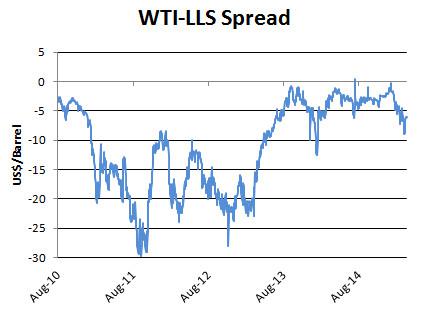

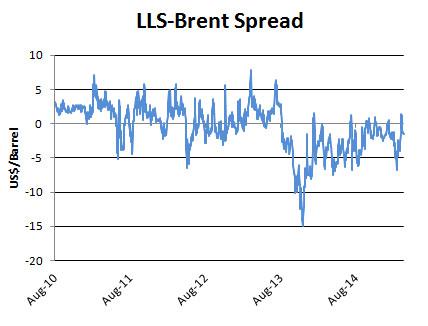

West Texas Intermediate's discount to Brent decreased week-over-week from -$7.86 to -$7.55. WTI's discount to Louisiana Light decreased week-over-week from -$8.25 to -$6.10.

The Baker Hughes oil rig count decreased by 12 to 813 rigs last week.

Baker Hughes Oil Rig Count

0 comments:

Publicar un comentario