Summary

- Gold has made new fresh highs in the Euro and Swiss Franc. Bull markets in these currencies could start from here.

- When The US dollar traded this strongly against the Euro before, the Euro always rebounded.

- Gold could easily rally through many resistance averages this year. Many technical traders thought oil had many support prices but many of them failed.

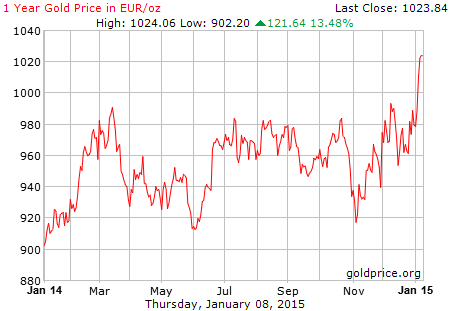

First of all, Gold has made many new highs in many currencies with the exception of the US dollar. There was firm resistance as shown in the chart below at 980 euros an ounce but Gold has smashed through that resistance recently (just this past week) and is now trading at 1029 euros per ounce (01-09-2015).

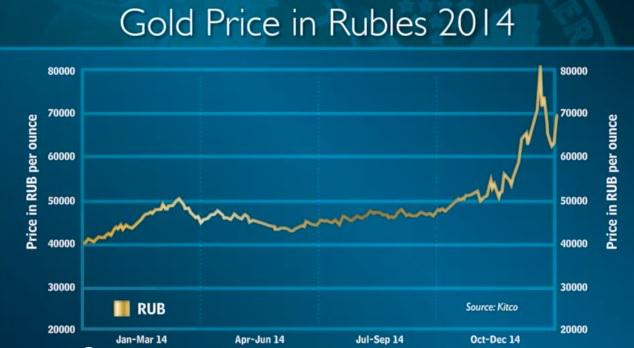

Also there was firm resistance at 1200 Swiss francs for an ounce of Gold and this landmark has been overcome with Gold presently trading at 1236 Swiss francs. In fact with all the negativity surrounding Gold, it may surprise you that Gold outperformed the vast majority of stock markets and currencies (more currency charts shown below) in 2014. So where is Gold headed next? It all depends on the US dollar.

We have had massive strength in the US dollar especially in the latter part of the year. Many analysts are saying now that parity with the euro is a certainty but I don't see it that way. What many forget is that the dollar has traded at these levels before against the euro and the euro has always bounced (see chart). What makes things different this time?

I expect US GDP to be substantially lower in the 4rth quarter as early estimates are lower than expected. If this turns out to be the case, how can the US increase interest rates? Also the majority of dollar strength has taken place as the FED has scaled back its QE. What do you think would happen to the dollar and Gold if the FED announced QE4? This scenario in my view is not only possible but probable especially if 4rth quarter GDP results are very weak.

Gerald Celente a widely acclaimed trend forecaster predicts the US will announce QE4 by the end of the second quarter. It will be interesting to see if it happens by then. On a final note, I would advise technical traders to look at the fundamentals in the Gold market instead of trying to pick the direction through charts and moving averages. Oil has collapsed from $108 a barrel to $47 in the space of 7 months and not many technical traders saw that coming. Surprises happen on the upside in bull markets and Gold could quite easily rally hard this year through resistance averages and leave many surprised. The last nut Gold has to crack is the US dollar and I for one believe it will be sooner than many think.

0 comments:

Publicar un comentario