Jan. 11, 2015 2:30 AM ET

.

Summary

- We think 2014 will be remembered for major events that are breaking down the current international order.

- US and Russian relations hit their lowest point since the Cold War and there is no sign of improvement.

- In the Middle East, ISIS threatens the status quo even as oil plummets and savages oil-producer revenues.

- Populist groups in Europe are emerging, with the most notable event being the upcoming Greek elections that could break up the European Union.

- Despite gold not doing much in terms of price in 2014, investors will want to own gold in 2015 if we see further turmoil.

"It is historians who retrospectively portray the process of imperial dissolution as slow-acting, with multiple over determining causes. Rather, empires behave like all complex adaptive systems. They function in apparent equilibrium for some unknowable period. And then, quite abruptly, they collapse."While many analysts and prognosticators may remember 2014 as the year that the Fed ended its massive quantitative easing program without consequences to the markets (it didn't as the Fed is still reinvesting its balance sheet), or the global economy continued its slow recovery process as the US surged, or that stock markets continued their climb to all-time highs, or even that Ali Baba (NYSE:BABA) opened itself up to the world. We think that 2014 will best be remembered as the year that the international order that we've had since the fall of the Soviet Union, started to crack.

-Historian Niall Ferguson Complexity and Collapse: Empires on the Edge of Chaos

Investors do not need to look hard to see major political events that seem to be breaking up the status quo and separating nations. The quote we opened this article with from Harvard professor and historian Niall Ferguson, suggests that if we're correct then we can see a break-down in the international order much sooner than anybody expects.

Of course this should interest all market participants as the implications of a major change in the global system will affect all kinds of investments, but for gold investors it is even more important. Gold is the currency and investment that one makes in times of financial chaos as it is the only currency (if held in physical form) that is not dependent on any other counter-party. Investors should remember that gold was one of the only assets that increased in value in 2007 and 2008 during the financial crisis.

Looking back on 2014 we think it will be remembered as the beginning of the end of the current international order. While this doesn't mean that we'll be living in caves and eating canned beans, it does mean that some major changes are coming in 2015 and years ahead, which investors should be prepared for and will get into later in this piece.

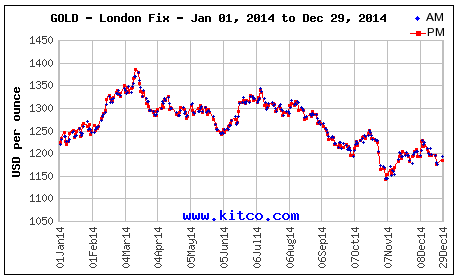

In terms of price action, we didn't see much from gold in 2014 as it essentially treading water for the year and ended the year with a slight 2% loss (though it certainly was volatile).

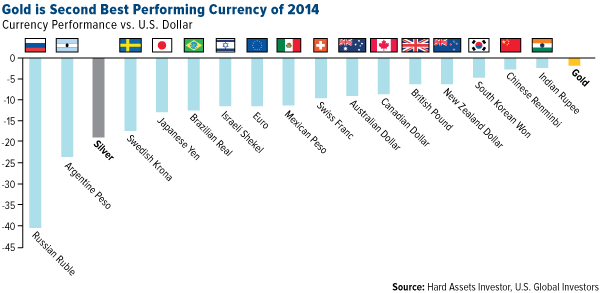

Though we do note that gold actually did extremely well when compared to other currencies.

Source: US Global Investors

But as we stated earlier, the significance of the year was in the nature of the geopolitical events that we saw around the world. In our opinion, these events are showing that our world is becoming more fractured and split - the opposite of the globalization and integration that we've seen over the past few decades.

The Ukrainian Civil War and Demonization of Russia

First and foremost, we cannot cover 2014 without mentioning the collapse of the Ukrainian government. While Ukraine in itself is a non-relevant player on the global scene, the collapse of the Ukrainian government was really the escalation in the proxy war between Russian and the United States. The results of this led to the capture/liberation (depending on your politics) of Crimea and then the escalating sanctions by the US and Europe on Russia.

These events were probably the greatest in terms of future impact to the world order as it now actively pits Russia against the US - each will actively work to destabilize the other and use proxies and alliances all over the world to do so. In our weekly gold investment letter we covered a very interesting recent visit by STRATFOR's George Friedman into Russia that covered many of these issues based on the Russian point of view. There are many takeaways but maybe the most important is that Russians believe that this is clearly US aggression and that Putin is much more secure than the West believes - we don't think there will be any backing down here despite the weak economic conditions in Russia.

Neither do we see the US backing down, so this is a formula for a continued downward spiral in these relations - leading to competition across the globe to weaken the other. Investors should remember that the greatest attack that Russia can make against the US is to attack the US Dollar - and we think that is what they have been doing and will continue to do. The more deterioration in the Russian economy, the more incentive that Russia has to do something rash - after all there isn't much for them to lose.

This brings us to…

Oil, ISIS, and the Middle East

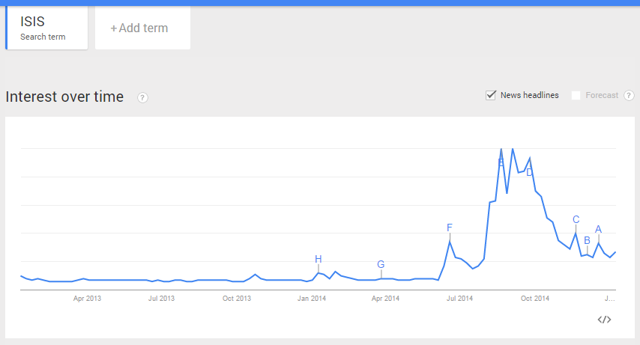

Sometimes it is hard to take an unbiased look back and remember how obscure something was that isn't obscure today. The Islamic State group ("ISIS") fits perfectly into that category.

As investors can see from a Google Trends search term popularity graph, at the beginning of 2014 there really was very little interest or knowledge about ISIS. Obviously, throughout the year that changed.

ISIS was another major event of 2014, which we think reflects more cracks in the international order. It is our belief that ISIS is not the cause of the problem, but rather, a symptom. It wasn't very long ago (2010-2011) that we saw the "Arab Spring" in the Middle East change the political landscape as many ordinary citizens revolted against years of oppressive regimes. Well, that Arab Spring ended with quite a thud as most of the countries have returned to a status quo of dictatorships, with some even more (such as Egypt) more brutal than ever.

But it's tough to bottle backup freedom after it has been released, and that's where radical groups like ISIS come in - they appeal to the frustration of the masses and offer an approach of violence as the only alternative to win back freedom. That's why we say ISIS is a symptom of a greater problem and not the cause, and this is extremely relevant because if it is a symptom than that means that even if ISIS is destroyed or falls apart, another similar group will take its place until the cause is removed.

Geopolitically that means that change will come as regimes are brought down. To further that prediction, the collapse in oil prices to around $50, will lead to more budgetary havoc in the Middle East, further radicalizing people and weakening the strangleholds on power that these regimes hold. Doubleline's Jeff Gundlach expressed his concerns in a recent interview:

Oil is incredibly important right now. If oil falls to around $40 a barrel then I think the yield on ten year treasury note is going to 1%. I hope it does not go to $40 because then something is very, very wrong with the world, not just the economy. The geopolitical consequences could be - to put it bluntly - terrifying.We don't think it has to go to $40 to have terrifying consequences, unless we see a miraculous rise in oil (which would have its own possibly negative consequences) we think it is too late - the dominoes for oil-dependent producers have already begun to fall.

Finally, to further emphasize that changes in the Middle East are coming fast, in December the 90 year-old king of Saudi Arabia fell ill and was hospitalized and many don't expect him to live much longer. What is even worse for Saudi's stability, is that all his successors are in their mid to late-70's - not really facilitating long-term political ambitions. You don't have to be a "Game of Thrones" fanatic to know that when it comes to succession that things can get pretty messy - and getting messy in Saudi Arabia would have implications that would go way beyond the oil price.

Let us also not forget that right next door we have ISIS that has ambitions to create an Islamic state spanning the Middle East and what better way to do this than to take control of the holiest city of Islam - Mecca?

A collapse in revenues, a young radicalized and jaded population, an old dying monarchy, and a new and powerful group willing to do anything it takes to rewrite decades old borders and completely change the status quo. We're about to see some real fireworks in the Middle East…

Populist Parties Gaining Strength in Europe

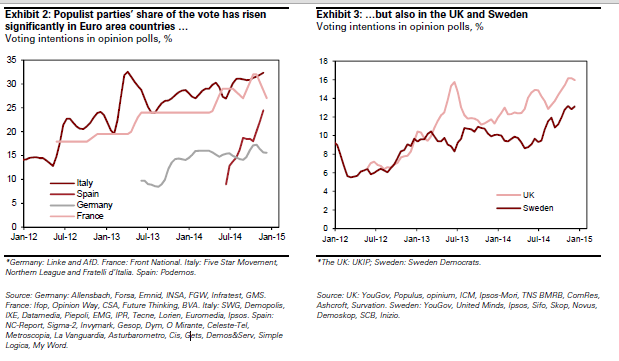

Across Europe we're seeing populist parties gather strength as they rail against the status quo.

Source: Goldman Sachs via ZeroHedge

As investors can see, parties across Europe in Italy, Spain, France, Germany, and even in non-EU countries like the UK and Sweden have seen their poll numbers rise consistently as the European economy treads water.

Many of these populist parties don't want to see minor changes - they want a complete change in the current approach, with many of them desiring an exit from the Euro if the EU does not give in to their demands. This is a big change from what we've seen over the last two decades as Europe has gradually moved to unite - now we're seeing the opposite as Europe is moving back towards sovereign empowerment.

From an American's perspective, this has some similarities with the US Civil War as national interests diverged from the independent state interests. But unlike the Civil War, in Europe there is a much weaker non-complete union between nations (rather than states) and the growing success of populist parties is only increasing the divide between nations. If the European Union is going to survive then nations will have to come closer together and make the union stronger - it can't be a pseudo-union with national interests trumping shared, joint interests or it will collapse.

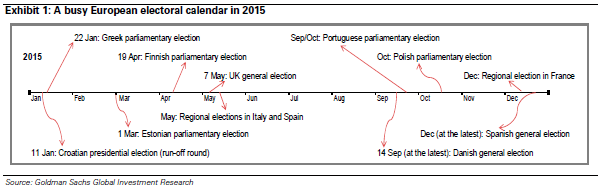

What is the kicker? A very busy European election calendar in 2015.

Source: Goldman Sachs via ZeroHedge

There are plenty of events here where Europeans can express their dissatisfaction with the status quo.

Not a bad time to transition to possibly the most important event not on that calendar - the Greek January 25th general election.

The Greek Elections

I don't think there are many more fitting ways than to have 2014 close with the third failure of the Greek president Antonis Samaras to win enough votes to elect a new president. The final failed vote was on December 29th and the results mean that Greeks have to head to the polls on January 25th to vote on the country's leadership.

The trouble, at least for markets, is that the anti-austerity Syriza party leads in polls and has adamantly insisted that there will be no more austerity. As Bloomberg reports:

Samaras has warned the election will determine Greece's euro membership and raised the specter of default in case of a victory by Tsipras, who advocates higher wages and a write-off of some Greek debt.

"Additionally, as to markets perception, the issue of debt negotiation is fundamentally important," Tsipras told Teodoro Andreadis Synghellakis in the question-and-answer style book. Syriza vows to write down most of the nominal value of Greece's debt once elected. "That's what was done for Germany in 1953, it should be done for Greece in 2015," Tsipras said in a speech in Athens Jan. 3.If I were a Greek citizen I would probably vote for Syriza and Alexis Tsipras as well - so I understand where the popularity stems from.

The problem here is that if Syriza wins and Greece holds firm to its demand of debt forgiveness, then the ECB and the EU will have to decide whether or not Greece should remain in the Euro. A few years ago, Greece was considered a systemic risk capable of bringing down the whole Euro, but now some are saying that it no longer is of much importance to the stability of the system.

The Federal Reserve and United States regulators thought the same thing when Lehman Brothers collapsed (and we know how that turned out), and we think this may be even greater as it's almost impossible to know what dominoes will fall as a result. What happens to European periphery bonds which are now paying interest rates at all-time low yields? What if a big move in bonds (up or down) causes one of the counter-parties of the trillions in CDS derivatives to default? What if the ECB doesn't implement some QE program before Greek elections? Will Russia come to Greece's aid and what would be those implications? What if the uncertainty leads countries to start selling Euros and the currency begins to collapse?

The only thing we know is that nobody really knows what will happen here.

Conclusion for Gold Investors

We haven't gone over a number of other events across the world that we saw in 2014 such as the increase in violence and regime change in Africa, Chinese and Japanese saber rattling over the Senkaku islands, and the potential of major currency and economic collapses in a number of South American nations.

All of this speaks to the instability in the world that we believe is due to the declining US influence on the international order. Even during the financial crisis of 2007, we saw much more in terms of world unity, as nations and central banks across the world tried to stem and control the impact of the US crisis - if we had a similar crisis today, we think we would see nothing close to that unity.

Financial market chaos, potential currency collapses, distrust on the international stage, and disruptive changes across the world are exactly why an investor should own gold. After all, it is the only currency that is not dependent on any other counter-party and as former Federal Reserve Chairman Alan Greenspan recently stated:

Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it…Yet gold lingers at around $1200 per ounce and most gold stocks are down 50-90% over the past few years - is there a better contrarian, yet fundamentally sound buy?

Thus we think this is a great opportunity for investors to accumulate physical gold and the gold ETFs (SPDR Gold Shares (NYSEARCA:GLD), SGOL, PHYS, and CEF) - though be very careful as ETFs work well in certain circumstances, but in others physical gold is much more desirable and investors should own both. For investors looking for higher leverage to the gold price, they may want to consider miners such as Goldcorp (NYSE:GG), Newmont Mining (NYSE:NEM), Agnico Eagle Mines (NYSE:AEM), or even some of the explorers and silver miners such as First Majestic (NYSE:AG) or Pan-American Silver (NASDAQ:PAAS). We're not suggesting these companies specifically (though we did recently issue a piece detailing our top five gold picks for 2015) - only suggesting them for further investor research. Investors interested in the miners may be interested in taking a look at some of our investment thesis detailing some of the rules we're currently looking for in a gold miner.

Finally, we think the real opportunities will be in the gold explorers, as their valuations are much lower than the miners and the fact of the matter is that these gold miners will be looking to expand reserves and buying out the quality explorers, so we'd suggest investors be aggressively investing in these quality explorers. For those interested in explorers or investors interested in keeping up with the gold market on a consistent basis consider following us (clicking the "Follow" button next to my name) or join our free email list where we send out a weekly email summarizing all the important events in the gold and silver industry, including all of our latest articles and research - it's a great way to keep up with the gold and precious metals market whether you are an individual investor or economist and its completely free.

We don't know what will happen in 2015, but we expect to see many more cracks in the international order as events speed up. Do not forget Professor Ferguson's reminder about complex systems, "and then, quite abruptly, they collapse." Investors should ask themselves what assets they want to own if things in the current international order break down further - we don't think there is any better investment than gold.

0 comments:

Publicar un comentario