by: Avi Gilburt

Nov. 16, 2014 5:57 AM ET

Summary

- Should we begin to look to the long side of the market?

- What are the long term implications?

- Upcoming week's expectations.

If someone told you back in the year 2001, when gold was below $300, that within 10 years it would approach $2000, would you have thought them to be crazy?

What if someone now tells you that gold can go from the $1000 region to $10,000 within the next 10-15 years? Sounds just as crazy, right? Well, since many of you already think I am crazy, then I guess this will just be par for the course.

Yes, this article is being written by one of the very few who came into 2014 exceptionally bearish on the precious metals. Remember my line that "2014 will be the year of the whipsaw and the year the bulls die?" Again, the market has followed through very nicely on both. But, not all the bulls have been vanquished just yet, and it should only be a matter of time until they are.

However, I will likely be going into 2015 very bullish. You can consider it my alternative take on "2014 comes in like a lion . . . or . . . bear, and out like a lamb . . . or . . . bull." But, this is simply how contrarians invest. When a market becomes exceptionally bullish, as the metals market was when I called the top in 2011, it is time to look in the other direction. And, now that the market is turning exceptionally bearish, well, it is time to begin looking the other way too .

We learned this lesson from Baron Rothschild, an 18th century British nobleman. After the panic that followed the Battle of Waterloo against Napoleon, he was credited as saying "Buy when there's blood in the streets, even if the blood is your own." But, amazingly, I still don't think blood is running in the streets walked by precious metals investors just yet. I think pain is being felt, but I don't think blood is running. Sadly, I think we may see a number of miners go out of business to signal that there is blood in the streets. I am also going to want to see more formerly bullish analysts declaring the end to the bull market.

But, it is clear that the market is starting to turn quite bearish. Last weekend, I cited many popularly followed analysts who have declared the bull market in metals to be dead. This week, a very bearish Market Watch article written by Howard Gold was forwarded to me. In fact, it was the headline article the morning we went long the metals in our Trading Room at Elliottwavetrader.net, which ended the day with a 9% gain in GDX from the lows we bought at the open. Yes, death of the metals indeed.

Within the article, Mr. Gold clearly presented the sentiment of most in the precious metals world: "can anyone seriously believe this isn't a long-term bear?" In fact, he was suggesting readers to consider selling their gold. Yes, he is suggesting you sell your gold as we approach the bottoming of this market. However, I stand here today, loudly and proudly proclaiming "Mr. Gold, I seriously believe this is not a long-term bear." Moreover, Mr. Gold, I am looking to be a buyer and not a seller!

And, seeing more and more articles like this should come as no surprise to those that regularly read my articles. Last week, I provided you with an article which explains why people buy at the highs, and sell at the lows. Well, if Mr. Gold sells his gold soon, as he has suggested to others, then he will likely look back years from now and realize he sold near the market low. But, again, this is simply human nature.

Yet, many of the former bulls, who have now turned bears - some of whom publish articles on Seeking Alpha - noted last week that they were shorting the metals market. But, what happens when someone arrives late to the party? Well, as most of the 3 year bear-party is now over, these newly inaugurated bears are feeling some pain in their brand new short positions. I would imagine many of them have even stopped out of those newly inaugurated short positions on Friday. Again, this is simply how markets work, and should have been expected if you have been reading my articles. Once a break down is seen, everyone jumps on board the "short-train," but that is usually the time the train reverses, and throws the new riders off before finishing off the final capitulation drop.

For now, I still do expect lower lows to be seen, as it is quite clear to me that this correction has not yet completed. As I said before, we will likely see lower lows, and most likely by the end of 2014. Furthermore, I will be treating that low as "the low," even though there still is potential for a lower low to be seen at the end of the 1st Quarter of 2015. Either way, I am going to be expecting some kind of rally at the start of 2015, and will remain open minded as to whether it is the start of the new multi-year bull run, or if it is the final corrective rally before a potential lower low at the end of Q1 is to be seen.

Very Long Term Implications

Now, for those that are not interested in short term trading, and are looking for the next bigger long term investing opportunity, I don't believe there is one being presented in any market which represents greater wealth creation potential than the precious metals market over the next half a year.

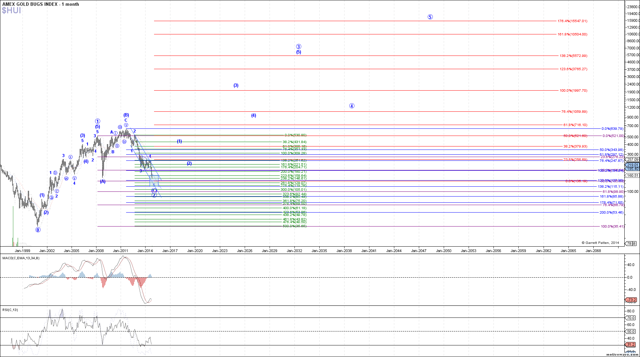

When we look at the HUI - Gold Bugs Index, it is quite clear that further lows will likely be seen. However, when one compares the relative extent of those lower lows to the projections we have once this bull market re-asserts itself, well, your feelings of greed may make it hard for some you to maintain "dry-powder" to buy at the lower levels we still expect.

(click to enlarge)

As you can see from the chart, based upon our Fibonacci Pinball method of Elliott Wave analysis, and using log scale calculations, we see the potential for more than a ten-fold increase in price for the Gold Bug Index within the next 10 -15years, with the further potential of thirty-fold increases over the next 20-25 years. And, it seems that the initial parabolic stage does not occur until the 2018-2020 time frame.

For many of you, this is likely music to your ears since you have been dreaming about this potential for decades, as you have maintained your belief in the imminent collapse of the monetary system or whatever other reason you maintain for a strong move up in metals. Others are probably looking at this as nothing more than the ranting of some crazy analyst.

But, while past performance is clearly not indicative of future performance, I want to remind you of something I said back in 2011. In my first gold article on Seeking Alpha on August 22, 2011, I provided you my topping target for gold, in the face of the parabolic gold run, when everyone was so certain we would be easily seeing over $2000. And, if you remember, gold topped within a few dollars of the target I provided a month before the top was struck.

But, what someone just reminded me of the other day, in response to a question from a commenter to that article, and even BEFORE gold actually topped, I provided the downside targets on August 23, 2011:

Based upon the Elliott Wave Principle, I would expect a very large pullback. In fact, the target for such a pullback will probably be a minimum low of $1,400, it could fall as low as $1000, or even as low as $700. It will depend upon how the decline takes form. But those are very viable targets for gold on the downside.

And, if you remember, when gold was up at the $1400 region, I gave it an opportunity to prove that a low had been struck. And, when it invalidated that potential, we started looking much lower, towards the 95-105GLD region target I have maintained since that time. And, it seems that many others have only now adopted my target.

Based upon this same methodology which identified the 2011 top and the potential bottoming region before we even topped in 2011, I am now providing you with the long term upside targets I see for the next 10-30 years in metals and miners before we even bottom. So, you can do with it what you will, but I know how I will be handling this information.

Upcoming Expectations

Last week, I noted that, one way or another, the market was going to rally to the 114-116 region, with an outside potential to see the 118/119 region. Ideally, I did not want to see a lower low this past week, but, rather, I wanted to see us begin a rally to take us to the upside target zone. My expectation was that many of the "NEW" short positions that have been recently purchased would have to be squeezed out of the market before we are able to head to the lower lows I expect. And all those that have recently shorted the market have clearly felt the pain for their late arrival.

On the GLD chart we have in our Trading Room at Elliottwavetrader.net, our minimal target for this rally was the 114.78 level, which we came within 5 cents of striking on Friday. While the pattern I am seeing does not look quite completed to the upside as of the close on Friday, I will re-asses how much higher the market can head early next week, based upon the next upside move. However, I am not hopeful of further large extensions to be able to take us beyond the 116.50 region.

As long as we remain below the 116.50 region, I will be looking for the next cue to short the market with a minimal target of the 105 region in the GLD, with the potential to extend to even lower levels within our long term target zone before this segment of the correction has completed.

Furthermore, as I said last week, my primary expectation at this time is that the next decline phase can very well be the final decline phase within this 3+ year correction. However, I will not likely be able to confirm that with a high degree of probability until we see the next rally into early 2015. Should the next rally only be corrective in nature, we will likely be hedging the long-term long positions we intend on buying at the bottom of the next decline. One way or another, I am expecting the commencement of the next larger bull market phase in the precious metals to begin in 2015.

0 comments:

Publicar un comentario