Pro-Cyclical Saturation

By Jeffrey P. Snider

The central insight into the Minsky moment is really about saturation, as that point represents where any system can no longer sustain growing marginal inefficiency. In fact, it becomes so inefficient that its entire forward dependence is predicated on simply more debt being issued to pay off old debt. In terms of the economy, that means so much of financial resources are being used up just to forestall contraction rather than representing incremental growth. The greater those margins of inefficiency, the more likely it is to hit "stall speed" and begin what is always an epic descent into the misallocation abyss.

That was clear enough in the housing bubble, as at some unknown point in the mid-2000s, the increase in mortgage debt owed nothing to the economy and was instead totally dedicated to keeping the enormous price structure from breaking apart. Almost the entire balance of a new mortgage was "used" up as the Greater Fool, allowing nothing more than the previous real estate "owner" to get out. The fact that so many dwellings were built upon that feverish fury simply speaks to the gross misallocation. It also details the distinct lack of true intermediation in credit, instead repurposed as a monetary "flood" of mindless credit predicated on volume.

But that is, again, somewhat misleading, as the buildup of credit was not contained within just the few years after the dot-com bust. Mortgage credit had been growing at an alarming rate throughout the 1990s, really since the S&L bust was finally "cleaned up" in a fit of quasi-too big to fail. Where S&Ls had previously been the entire basis of mortgage finance, the shadow system took over in the 1990s as GSEs and then private label securitization pushed out all competition. They could do so based solely on their new funding model, wholesale money (especially eurodollars), rather than deposits and traditional banking aggregation.

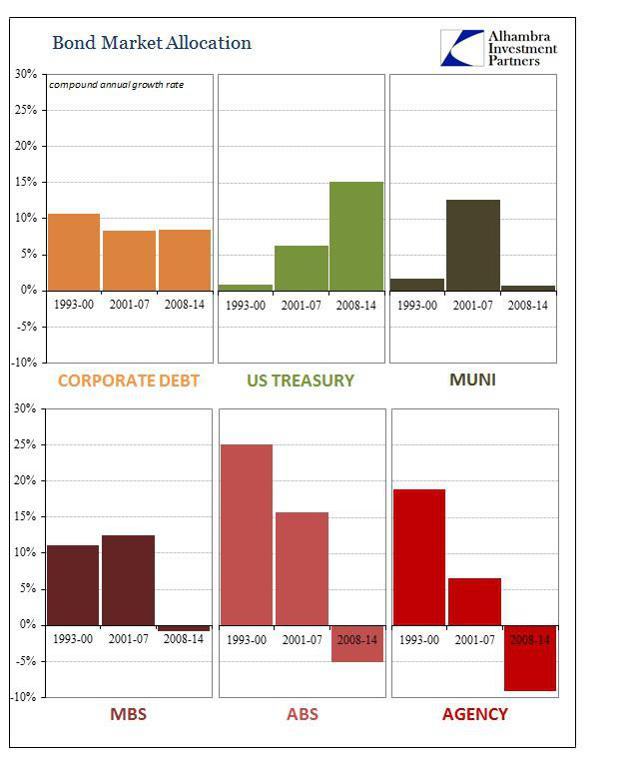

(click to enlarge)

Looking at the bond market, that is absolutely clear in the compound annual growth rates of the ABS, agency and MBS sectors. The demarcation of the Great Recession is equally clear, as mortgage finance has come unglued in light of that Minsky moment that occurred somewhere around 2006. That might be oversimplifying too much, as there was no one factor involved in turning the bubble to bust, but the fact remains that mortgage finance was utterly decimated and, more importantly here, has remained so.

In the place of mortgages, the US Treasury and corporate bonds have filled, partially, the desire for new issuance. Those are really the only two sectors left with any kind of actual growth, as munis have a positive number but debt there has really been flat these past six years. That has presented all sorts of problems in financial plumbing, since MBS as collateral formed the backbone of the marginal growth in repo - with nothing but UST to take up the slack (complicated by QE and other factors like Dodd-Frank).

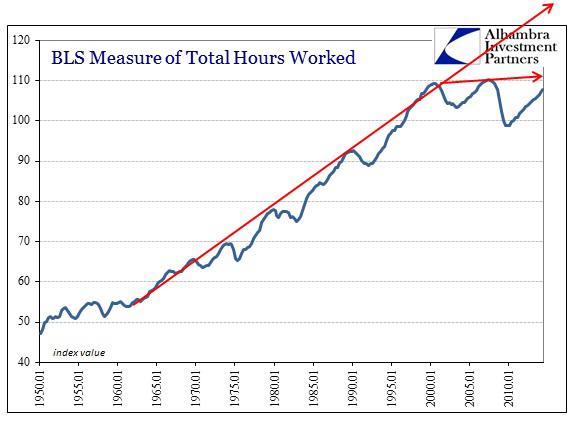

To a monetarist, that might go a long way toward explaining the reasons for the lack of real recovery in the economy, especially since debt = activity for them. However, that misses the central premise that is just now being incorporated into the wider range of dissatisfaction. There have been problems in the economy, particularly labor and wages, that go back much further than the Great Recession. In fact, as I noted earlier today, even the current vice chair of the FOMC seems keenly aware of this distinct deficiency in the economic trajectory.

That raises a central issue with this debt appeal going back now past even the turn of the century. As I said above, debt growth had been tremendous throughout the 1990s and into the mid-2000s, yet "somehow" the economy downshifted somewhere in there, despite the monetarist appeal to massive credit.

The answer to the non-monetarist lies in a partial observation of Minsky, namely the growing inefficiency of debt as it produces (likely the wrong word to use here; more like "leaks") economic activity. Instead of viewing the credit history of the past four decades as a series of bubbles, in this framework, we instead see one continuous cycle of growing inefficiency broken only periodically by actual market attempts at self-correction. And each of those attempts, which grow only larger over time (going back past the dot-com bubble to even the smaller junk bond bubble of the 1980s and smaller real estate "anomalies" that took down the S&Ls to begin with), are over-ridden by a policy regime that courts no value in contraction and creative destruction.

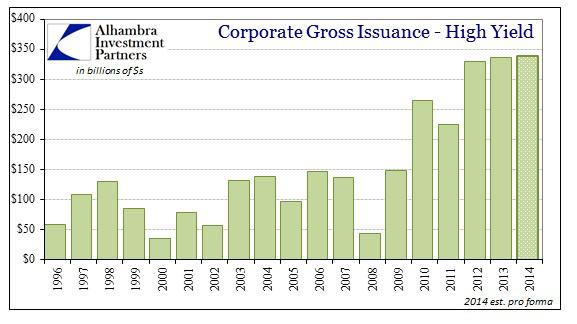

The current spike in corporate debt is exactly this kind of behavior, now gone into once again dangerous proportions. Back in May, Bloomberg cataloged what looks like bubble behavior, but what is really just higher proportions of inefficient financial utilization.

Loan agreements have "dramatically weakened" and it's easier than ever for borrowers to boost earnings in more ways than investors may realize, including "extremely speculative" cost savings, said Xtract's Pisano, who is based in Westport, Connecticut. Those that do cap add-backs limit them to about 25 percent of Ebitda, up from 15 percent a year ago, he said.

About 66 percent of junk-rated bonds sold this year scored by Moody's Investors Service included at least one adjustment to earnings the credit rater considered "aggressive," up from 59 percent in 2013 and just 40 percent in 2011. Moody's didn't track the same historical data for loan issuers, though speculative-grade companies will often have both loans and bonds.

This is an extension of the plague of cov-lite that has hit every form of corporate junk since QE3 started the mania, and is really the combination of everything from pricing problems to loose balance sheets to debt that should have likely remained unissued. And that is the degree of inefficiency that plagues the economy, as companies that should be on their way out are instead given a stay of execution by a bond market desperately searching for forward momentum as a feature of persistent repression. Instead of focusing credit on "worthy" projects with more than financial risk, instead, everything and anything gets funded by looser and looser attention to actual risk.

That is the opposite of intermediation, which is a genuine and vital need in a true capitalist system, and it has spread out in quantities that we never really thought possible.

While overall corporate debt growth has remained largely constant since 1992, that takes no account of the proportion of junk within it. Since 2012 began (through July 2014), $863 billion of junk bonds have been issued (which will likely take it over $1 trillion at current rates of issuance). That compares to only $817 billion issued in all of the eight years between the beginning of 2000 and the end of 2007 (the last "cycle" peak). Talk about inflation.

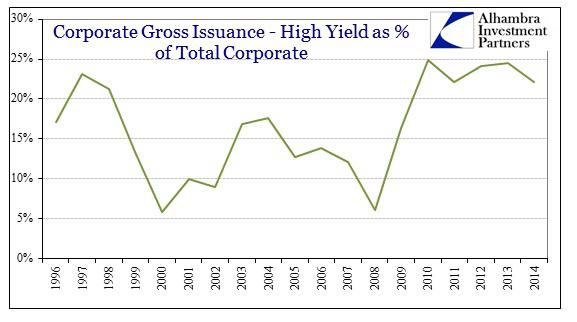

It is now just routine to see between one-fourth and one-fifth of all corporate debt as a junk obligor (and this does not even account for leveraged loans and other forms of low-grade corporate credit), which is precisely opposite the intent of junk bonds to begin with - this market was supposed to be a last resort, not a mechanism of permanent funding of the woefully inefficient. In economic terms, this has taken subprime corporate lending to the mainstream, something apparently monetarists condone with their willful appeals in this manner time after time. The net effect on the economy over time is a lack of dynamism, as the old businesses are propped up by debt; where failure once amounted to a net gain as new firms were given room to grow and expand, especially the gazelles that almost all labor growth depends upon.

But what is perhaps most unappreciated about all this is the now-pro-cyclicality of it. Instead of a much more modest junk market that sees a steady flow of corporate failures, we now get them bunched together in massive waves, like those of 2008-09 and 2000-02. That has as yet been unaccounted for as it relates to the overall economic problems, especially labor. The artificial grouping of failures and defaults is not the same as a steady flow of creative destruction that opens up space for new avenues of growth. These failure and default waves are purely destructive without much by way of enhancing intermediation.

That offers a more potent explanation as to why the economy has downshifted so far under the regime of debt and central planning, as the smaller firms that once accounted for all advance are cast aside with the rest. "Good" and valuable firms that foster economic efficiency are thrown out in the downturn and then overwhelmed by the flood of inefficiency that follows in the monetarist response of repression. The bond market is, by all appearances, operating in this manner, once more waiting out the exact moment of realization rather than rationalization.

0 comments:

Publicar un comentario