How close is the Fed to “mission accomplished”?

Gavyn Davies

Jun 23 13:25

The markets were little moved by Fed Chair Yellen’s press conference last week, though there was a slight sigh of relief that the Fed did not follow the example of the Bank of England in shifting towards hawkishness. The FOMC’s neutral stance, for the moment, was no great surprise.

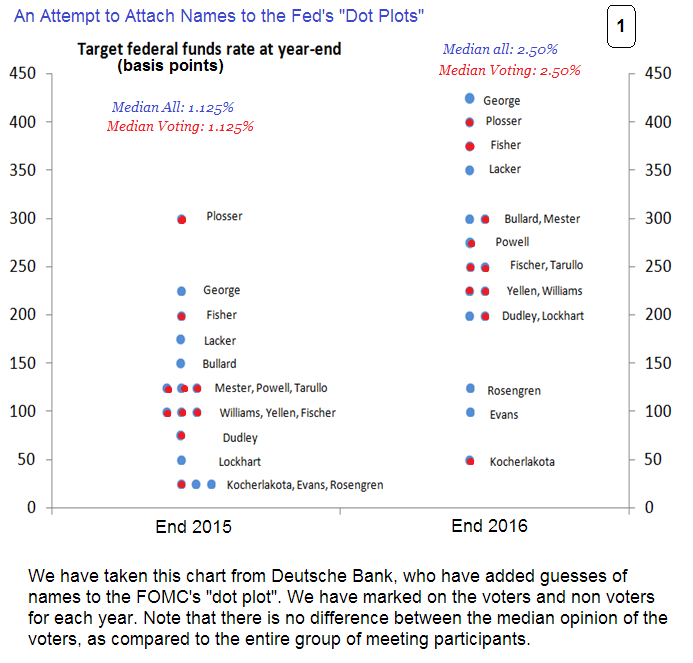

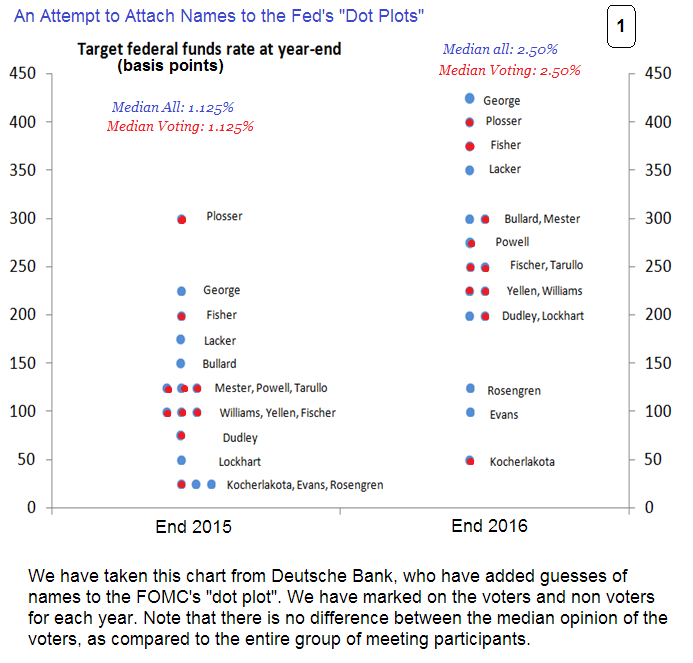

More interesting is the fact that the FOMC’s “dot plot” showed that there is still a wide disparity of opinion among committee members about the appropriate level of interest rates in 2015 and 2016.

This disparity is much greater than the difference in the individuals’ economic forecasts would appear to justify, so it suggests that the policy reaction functions between the hawks and the doves remain very far apart. This argument has been shelved during the period of tapering, when the Fed is on autopilot. But the debate is very much alive beneath the surface. And Ms Yellen still seems to be firmly in the dovish camp.

(Note: some of this debate is slightly technical. Readers not interested in the technicalities should jump to the final section on Yellen’s “balanced approach”.)

The hawks’ case

Much of the dispute hinges on whether the Fed is now close to completing the job it embarked upon in 2009, when both sides of its twin mandate – 2 per cent inflation and maximum employment – were being missed by a very wide margin.

The hawks argue that this is no longer the case. For example, St Louis Fed President James Bullard, who is shifting rapidly into the hawkish camp, argued recently that the Fed has now gone most of the way to completing its task, since both unemployment and inflation are closer to their objectives than they have been at any time for many years.

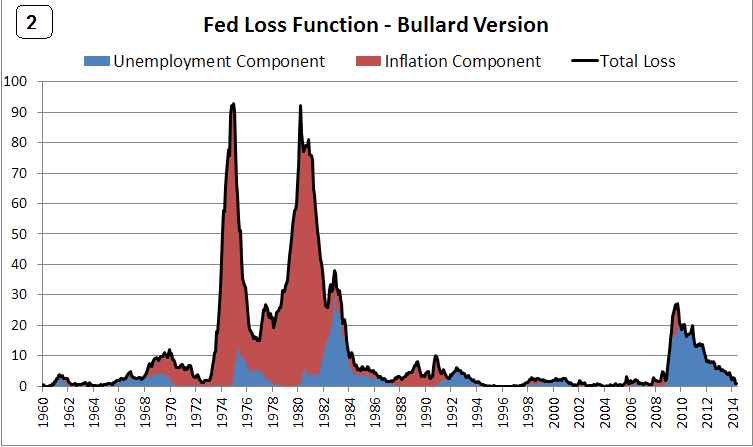

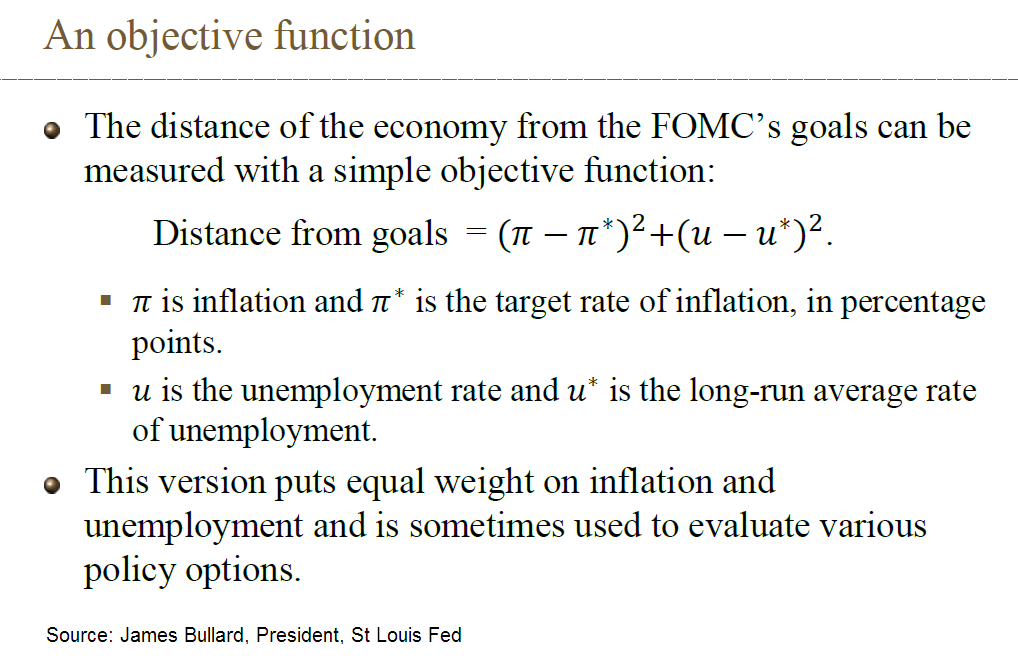

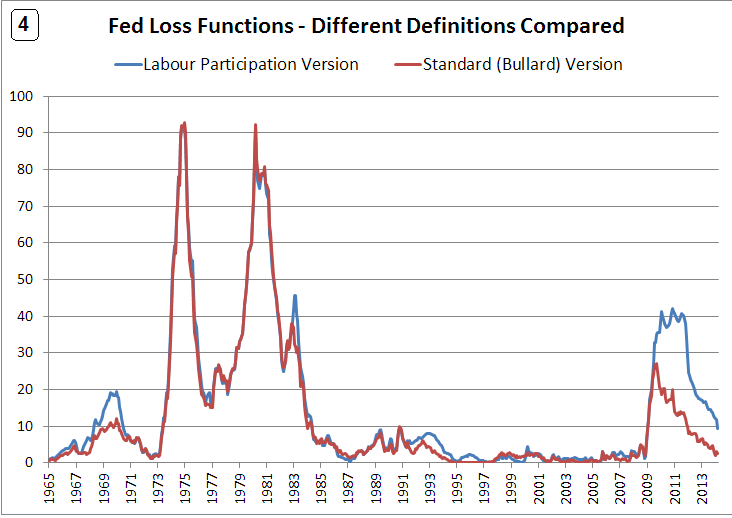

He combines the two parts of the twin mandate into a single measure of economic “loss”, using a standard formula, or “objective function”, which punishes deviations from target in either direction by increasing amounts (see footnote [1]). The higher the “loss”, the worse is the Fed’s performance.

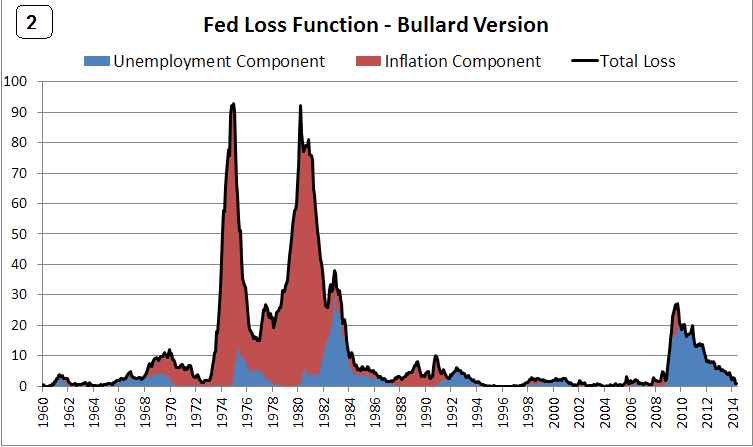

Bullard’s estimate of the loss is reproduced in Graph 2, along with an attribution of the loss into its two component parts – the distance of inflation and unemployment respectively from target.

Three points about Bullard’s calculation are important to note.

The doves’ reply

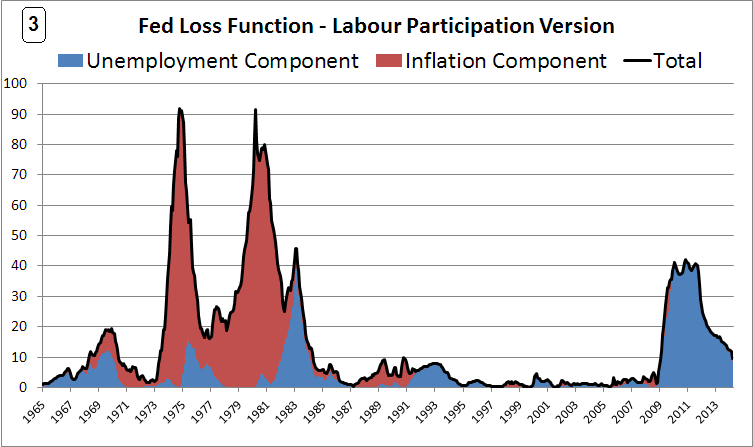

How would the doves reply to this argument for an early normalisation in interest rates? Easy – they would simply repeat their view that the unemployment rate is not a good measure of the genuine amount of spare capacity in the labour market, because in their opinion the labour force participation rate has been temporarily depressed by the recession, and will rebound as discouraged workers are induced back into employment. This means that the total “unemployment gap” is much greater than the official unemployment figures would imply.

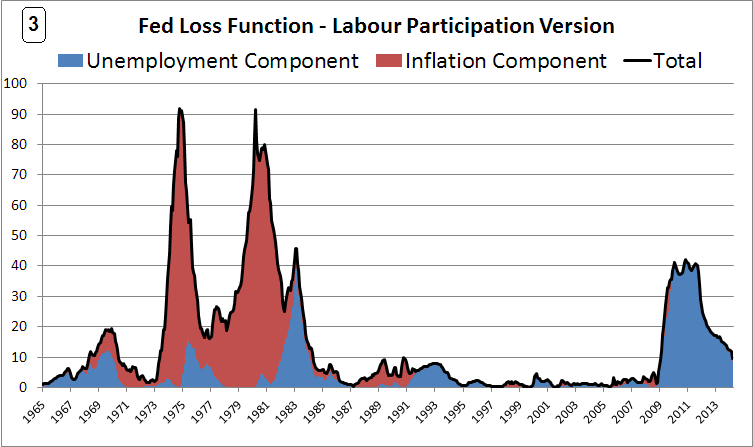

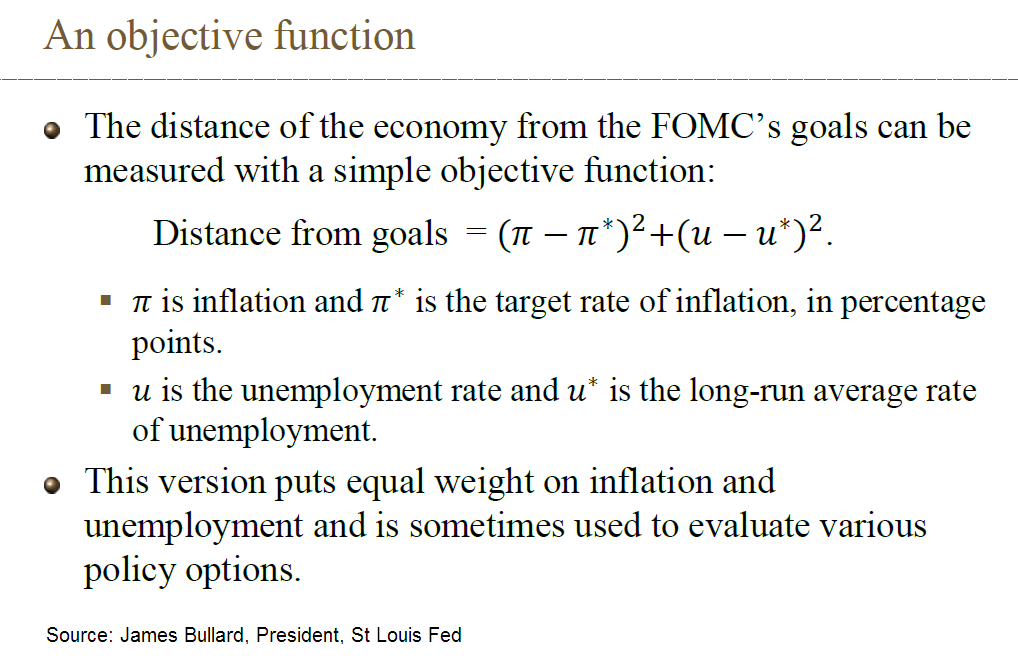

In Graph 3, I have added an estimate of the labour force participation gap (plus underemployed workers) made by Andrew Levin at the IMF into the official unemployment rate to produce an estimate of the total unemployment gap. This is then used instead of the official unemployment rate to calculate an economic loss function which might be believed by the doves.

Not surprisingly, this shows that the loss remains abnormally high, higher in fact than at any time other than during the disastrous inflationary period from 1973-83. This high level of economic loss, driven entirely by the unemployment gap component, offers a justification for retaining abnormally low interest rates for a much longer period.

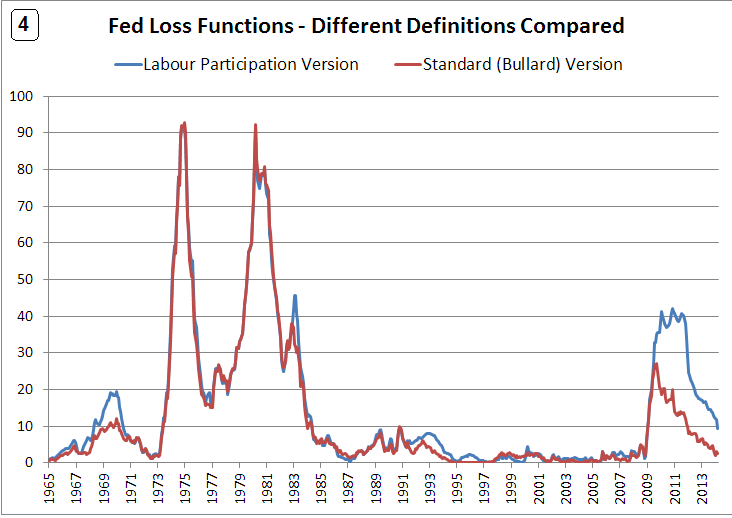

For comparison, the two loss functions are shown side by side in Graph 4.

Yellen’s “balanced approach”

The dispute between hawks and doves about the participation rate is, of course, very familiar territory, and it shows no sign of being resolved. Ms Yellen did not change her view on this last week, when she said once again that she thought that part of the decline in the participation rate would be reversed as the economy recovers.

She was also questioned on a related issue, which is why core and underlying inflation rates have been rising in the past three months, if there is still so much slack in the labour market. She dismissed the rise in inflation as statistical “noise”, which is slightly odd since it has shown up in several data series which have supposedly had the noise removed from the data.

When pressed further (see page 15 here), Ms Yellen fell back on what she believed a “balanced approach” would imply for policy if inflation were above target:

This is an important statement, which triggered surprisingly little discussion last week. It implies that the Chair would be likely to pay much more attention to a high unemployment gap, caused in her view by abnormally low participation rate, than she would pay to a minor and temporary overshoot in inflation. Translated into the loss function, it would suggest that a high level of economic loss caused by a large unemployment gap might be used to justify a low level of interest rates, even if inflation were somewhat above target.

The manner in which she framed the “balanced approach” therefore reveals that Ms Yellen remains a convinced dove, even if inflation moves “temporarily” above 2 per cent. With the unemployment gap still very large in her opinion, she is clearly not ready to stand back and declare “mission accomplished”.

—————————————————————————————————

Footnote [1]

More interesting is the fact that the FOMC’s “dot plot” showed that there is still a wide disparity of opinion among committee members about the appropriate level of interest rates in 2015 and 2016.

This disparity is much greater than the difference in the individuals’ economic forecasts would appear to justify, so it suggests that the policy reaction functions between the hawks and the doves remain very far apart. This argument has been shelved during the period of tapering, when the Fed is on autopilot. But the debate is very much alive beneath the surface. And Ms Yellen still seems to be firmly in the dovish camp.

(Note: some of this debate is slightly technical. Readers not interested in the technicalities should jump to the final section on Yellen’s “balanced approach”.)

The hawks’ case

Much of the dispute hinges on whether the Fed is now close to completing the job it embarked upon in 2009, when both sides of its twin mandate – 2 per cent inflation and maximum employment – were being missed by a very wide margin.

The hawks argue that this is no longer the case. For example, St Louis Fed President James Bullard, who is shifting rapidly into the hawkish camp, argued recently that the Fed has now gone most of the way to completing its task, since both unemployment and inflation are closer to their objectives than they have been at any time for many years.

He combines the two parts of the twin mandate into a single measure of economic “loss”, using a standard formula, or “objective function”, which punishes deviations from target in either direction by increasing amounts (see footnote [1]). The higher the “loss”, the worse is the Fed’s performance.

Bullard’s estimate of the loss is reproduced in Graph 2, along with an attribution of the loss into its two component parts – the distance of inflation and unemployment respectively from target.

Three points about Bullard’s calculation are important to note.

- First, virtually the whole of the loss in the period since 2008 has occurred because unemployment has been well above target, with inflation component playing almost no role.

- Second, the current level of the loss is indeed very low, suggesting that it is almost “job done” for the Fed. In fact, the Fed has been closer to its twin mandate for only 25 per cent of the time since 1960.

- Third, Bullard argues that, with the Fed so close to completing its job, there is no longer any reason for short term interest rates to be so far below normal levels.

How would the doves reply to this argument for an early normalisation in interest rates? Easy – they would simply repeat their view that the unemployment rate is not a good measure of the genuine amount of spare capacity in the labour market, because in their opinion the labour force participation rate has been temporarily depressed by the recession, and will rebound as discouraged workers are induced back into employment. This means that the total “unemployment gap” is much greater than the official unemployment figures would imply.

In Graph 3, I have added an estimate of the labour force participation gap (plus underemployed workers) made by Andrew Levin at the IMF into the official unemployment rate to produce an estimate of the total unemployment gap. This is then used instead of the official unemployment rate to calculate an economic loss function which might be believed by the doves.

Not surprisingly, this shows that the loss remains abnormally high, higher in fact than at any time other than during the disastrous inflationary period from 1973-83. This high level of economic loss, driven entirely by the unemployment gap component, offers a justification for retaining abnormally low interest rates for a much longer period.

For comparison, the two loss functions are shown side by side in Graph 4.

Yellen’s “balanced approach”

The dispute between hawks and doves about the participation rate is, of course, very familiar territory, and it shows no sign of being resolved. Ms Yellen did not change her view on this last week, when she said once again that she thought that part of the decline in the participation rate would be reversed as the economy recovers.

She was also questioned on a related issue, which is why core and underlying inflation rates have been rising in the past three months, if there is still so much slack in the labour market. She dismissed the rise in inflation as statistical “noise”, which is slightly odd since it has shown up in several data series which have supposedly had the noise removed from the data.

When pressed further (see page 15 here), Ms Yellen fell back on what she believed a “balanced approach” would imply for policy if inflation were above target:

When we see some conflict between achieving the two objectives …we would consider … just how far we are from achieving each of the objectives and if the distance from achieving an objective is particularly large, it would be consistent with the balanced approach that we would tolerate some movement in the opposite direction on the other objective.

This is an important statement, which triggered surprisingly little discussion last week. It implies that the Chair would be likely to pay much more attention to a high unemployment gap, caused in her view by abnormally low participation rate, than she would pay to a minor and temporary overshoot in inflation. Translated into the loss function, it would suggest that a high level of economic loss caused by a large unemployment gap might be used to justify a low level of interest rates, even if inflation were somewhat above target.

The manner in which she framed the “balanced approach” therefore reveals that Ms Yellen remains a convinced dove, even if inflation moves “temporarily” above 2 per cent. With the unemployment gap still very large in her opinion, she is clearly not ready to stand back and declare “mission accomplished”.

—————————————————————————————————

Footnote [1]

0 comments:

Publicar un comentario