BlackRock

The monolith and the markets

Getting $15 trillion in assets on to a single risk-management system is a huge achievement. Is it also a worrying one?

Dec 7th 2013

NEW YORK

.

EAST WENATCHEE, in Washington state, is known for its apples, not for its financial services. But in a data centre nestled between the orchards and hills, a cluster of 6,000 computers oversees the assets of over 170 pension funds, banks, endowments, insurance companies and others.

Whirring around the clock, the machines look at what interest-rate changes, or bank collapses, or natural disasters could mean for trillions of dollars of assets. Around the world, 17,000 traders have the computers’ assessments of these risks at their fingertips when they buy or sell assets.

.

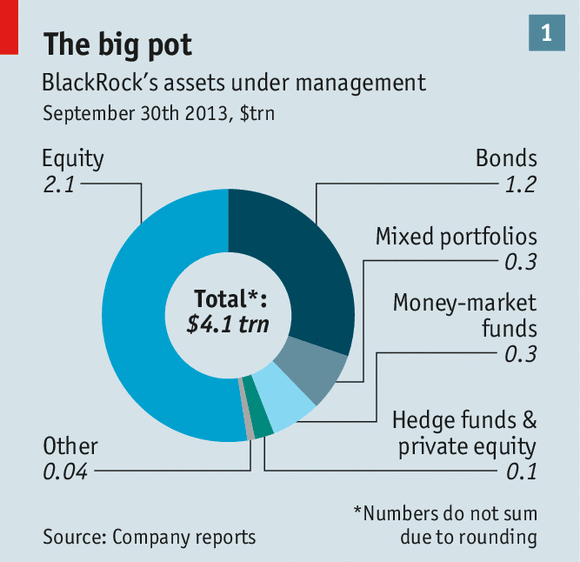

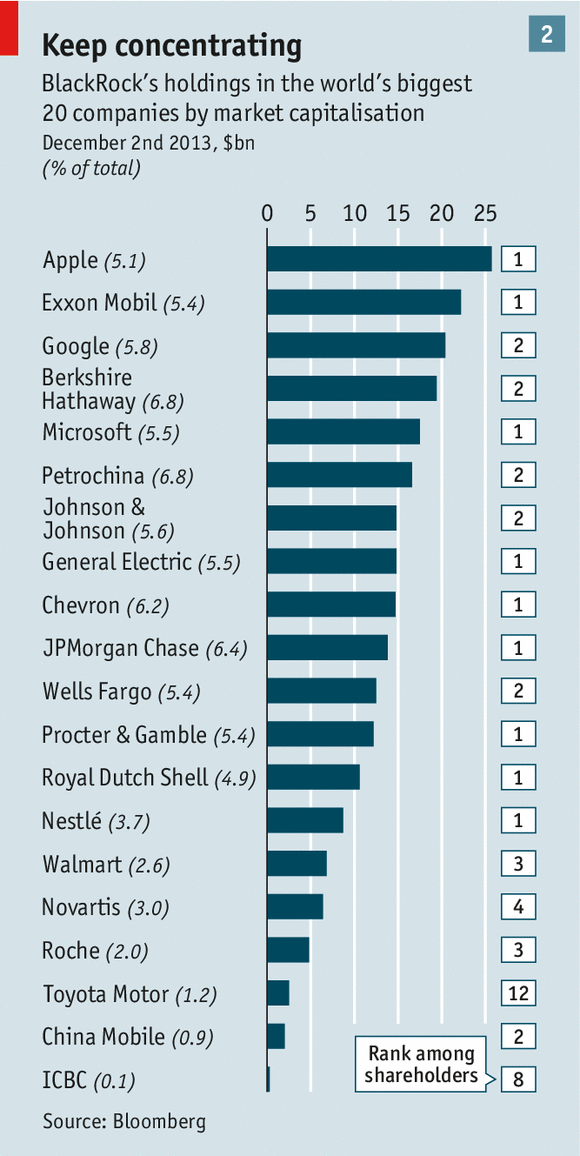

The data centre forms the heart of BlackRock, an asset-management company that is the world’s biggest investor. Founded in 1988, it has $4.1 trillion in assets under management, making it bigger than any bank, insurance company, government fund or rival asset-management firm. It single-handedly manages almost as much money as all the world’s private-equity and hedge funds. Though its holdings are mostly equities—it is the biggest shareholder in half of the world’s 30 largest companies—it also holds bonds, commodities, hedge funds, property and just about anything anyone would ever want to invest in (see chart 1).

But “Aladdin”, the risk-management platform that occupies all those computers in the orchards, is not just used to look after BlackRock’s $4 trillion. The firm makes its facilities available in whole or in part to managers looking after $11 trillion more, a tally that has recently been growing by about $1 trillion a year. All told, Aladdin keeps its eyes on almost 7% of the world’s $225 trillion of financial assets.

This is unprecedented—and it means flaws in the system could matter to more than just BlackRock, its investors and its customers. If that much money is being managed by people who all think with the same tools, it may be managed by people all predisposed to the same mistakes.

Encounter in the dawn

.

.

Mr Fink was sidelined, leaving him time to ponder how Wall Street’s titans understood the risks they took to make money. He set up BlackRock as much to offer clients a better understanding of risk as to manage their money. Originally a part of Blackstone, a private-equity firm, it was sold in 1994 and floated in 1999. Today it is worth $51 billion, making it America’s 17th largest financial firm by market value.

BlackRock quickly earned a reputation for understanding the complex securities dreamed up by ever more creative Wall Street types. Whereas buyers of a company’s shares only need to understand that one business, buyers of a mortgage-backed security of the sort Mr Fink pioneered must look at how several thousand underlying loans will perform. BlackRock took up the challenge. Its analytical legwork, originally undertaken by a humble Sun Microsystems workstation wedged between the fridge and the coffee machine in BlackRock’s one-room office, was the key to the firm’s early success as an asset manager specialising in bonds.

By 2008, after 20 years of growth and the acquisition of part of Merrill Lynch, BlackRock had more than $1 trillion under management. As crashing banks revealed how spectacularly poorly the financial world had understood the complex and shady instruments it had put its money into, BlackRock, far from needing a bail-out, was something of an antidote. When the American government found itself owning or guaranteeing toxic assets, it turned to BlackRock, which was seen as having more limited conflicts of interest than everyone else concerned, to analyse, value and sell them. The company got similar business from Greece and Britain. Larry Fink became a Washington insider, his name floated as a chief for bailed-out banks, or later as a potential treasury secretary. In 2009, as others retrenched, BlackRock snapped up Barclays’ asset-management business, boosting the assets under its control to more than $3 trillion.

It looks set to grow further. As post-crisis regulations cut the banking industry back down to size, much of what the banks used to own is flowing to capital markets. Pension funds, sovereign-wealth funds, endowments, insurance companies and asset managers will all look to buy them there, and many will do so through BlackRock. The company also has opportunities for growth in its thriving business with smaller clients (a third of its work is for retail investors saving for their retirement or a college fund). American personal bank accounts currently contain $10 trillion earning virtually no interest.

One reason investors flock to BlackRock is that its purchase of the Barclays business made it a huge force in “passive” investment products such as exchange-traded funds (ETFs); these now account for 64% of its assets under management. Such instruments aim merely to track indices—the S&P 500, London’s FTSE and their equivalents in the bond world—and charge far lower fees than “active” mutual funds or hedge funds, which need to cover pricey research and trading teams. That said, BlackRock is not averse to earning such fees: with over $1 trillion in assets, its active management business is one of the biggest there is. Indeed some outsiders suspect that, as both businesses get bigger, accommodating the different cultures associated with ETFs and active management may become a problem for the company.

Since BlackRock mostly just invests its customers’ money on their behalf, it is, it says, a much safer source of financing for the economy than banks, which can find themselves without the money to pay off their depositors, and thus crash. As long as the firm does not become an investor in its own funds, which it shows no sign of doing, BlackRock can plausibly claim to offer little if any systemic risk. As with smaller asset managers, such as Vanguard, Fidelity or PIMCO, a fall in the value of the assets under management matters to the investors concerned, but has no knock-on effects. Regulators fret about some aspects of BlackRock’s operations, such as money-market funds—banklike vehicles which struggled in 2008. But mostly they seem to accept the arguments put forward by BlackRock and its lobbyists.

Mr Fink encourages the perception that the company is merely big, not special—perhaps even a little dull. He delights in drawing a contrast between the flashiness of Wall Street and his nondescript midtown Manhattan offices. He pulls a face when reminded that a former lieutenant described BlackRock as “one of, if not the, most influential financial institutions in the world.” Speak to anyone in markets, however, and they will agree with the assessment. “If you are looking to buy anything, or sell anything, or invest anything, it’s very difficult to get around BlackRock,” says the boss of a large European insurer.

.

Because BlackRock is often their largest shareholder (see chart 2), companies care what it thinks, even if the nature of its ETF business means that its level of investment in them is to some extent predetermined (to track indices, the company needs to keep hold of large chunks of the biggest companies on the market). When Stuart Gulliver took over HSBC, a bank, in early 2011, he flew to New York to ask for Mr Fink’s support. And BlackRock prides itself on getting access to market-moving information just as any investment bank’s trading desk would.

Marketing presentations boast of the “access advantage” enjoyed by BlackRock, using “deep relationships with government and corporate issuers” to put it “in the flow of the most current information”. That advantage is at least in part a factor of its awesome size.

The sentinel

Who exactly pays to gain the system’s insights is not a matter of record, but a fair number of BlackRock’s asset-management rivals use it, as do banks, pension funds and insurers. Deutsche Bank’s investment arm, which manages €934 billion ($1.3 trillion), announced in November that it was migrating to the platform. Including those of BlackRock itself, Aladdin keeps track of 30,000 investment portfolios. Some of the clients use just the risk-management services; about a third use Aladdin to manage their portfolios and process trades, too. The $400m the company can expect in annual fees from outside users goes a long way to meeting the costs of the system and the nearly 2,000 employees who run it.

Aladdin, like the little Sun machine next to the company’s original fridge, is there to help people who manage money understand what they own. An institution like CalPERS—which uses Aladdin to keep track of the $260 billion it has invested to pay for the pensions of Californian public employees—needs to understand when its bonds will come to maturity, or how its assets will move if interest rates fall, or what would happen if a counterparty went bust. Aladdin is the tool it uses for the job.

The system is based on a large and, its creators say, particularly well quality-controlled trove of historical data. On the basis of that information it uses “Monte Carlo” methods, which produce a large, randomly generated sample of the huge range of possible futures, to build up a statistical picture of what could happen to all sorts of stocks and bonds under a range of future conditions.

These risk assessments cover both likely futures that matter day-to-day, and less probable but highly salient ones. A portfolio can, say, be stress-tested by being put through market turmoil modelled on that which followed Lehman Brothers’ collapse, to see what happens. Users can see their portfolio’s predicted response to a “tapering” of the Federal Reserve’s asset-buying programme or to the onset of a global flu pandemic.

The aim is not just to figure out how each stock, bond and derivative in a portfolio would move. It is also to check how correlated those movements are, and how that correlation could amplify a shock. For example: combining shares in an Indonesian bank, a bond issued by a European power company and a basket of mortgages secured on Canadian shopping malls might seem like a sensibly diversified portfolio.

But some changes in credit availability might set them all tumbling. That is the sort of thing that Aladdin, having tracked such assets through previous crises, is meant to spot. Armed with insights from these simulations, traders managing large, complex portfolios can tweak their holdings accordingly.

This sounds like a useful force for stability, and to the extent that it provides a deeper understanding of risk it probably is. But the sheer size of the endeavour brings two linked worries to mind. The first is that institutions which buy this level of risk analysis from a third party are diverting resources away from developing those skills internally. “There’s no way you can get the same understanding of risk if you developed the capability in-house, versus getting it off the shelf,” says an investment manager at a $500 billion-plus fund which looked at implementing Aladdin.

Not doing your own risk analysis means there is a danger that you will not fully understand the analysis done on your behalf. “You can look at all these risk reports and you get numb to what it actually means,” the investment manager says. Receiving three-dimensional bar charts by the bushel from BlackRock’s models is of limited use without the internal procedures necessary to make the best use of them, and a lack of in-house capability might lead those procedures to atrophy.

Broken circuit

If companies do not understand the risks they are taking that is mainly their lookout (though if they are big and highly leveraged, the danger spreads). The second worry is more systemic. The market price for any asset is in theory arrived at by buyers and sellers independently forming their own views of the asset’s worth, often using competing methodologies to reach their conclusions.

BlackRock’s success means that more and more of the market is thinking in the same way. As participants each start fretting about broadly similar things, such as how a slowdown in emerging markets might impact their portfolios, they will be guided in part by BlackRock’s analysis.

Buyers, sellers and regulators may all be relying on the same assumptions, simply because they are all consulting Aladdin. In a panic, this could increase the risk of all of them wanting to jump the same way, making things worse.

Privately, some market participants fret that BlackRock’s genie is creating a new orthodoxy when it comes to analysing assets. That is especially true for complex structures which require its forensic expertise to unpick.

“Nobody understands some of this stuff” without going through BlackRock, says a portfolio manager who uses Aladdin and regularly trades with the firm. A potentially worrying development is that it is now possible to engineer bonds to maximise the chances of BlackRock investing in them.

The disturbing parallel is with credit-rating agencies such as Moody’s and Standard & Poor’s in the run-up to 2008. Investors blindly relied on the agencies’ analysis of financial constructs underpinned by subprime mortgages, many of which were engineered in such a way as to ensure AAA-rated status but subsequently defaulted anyway. BlackRock’s models are undoubtedly more sophisticated than the credit-rating agencies’, and their use is not mandated by regulators. But Mr Fink is the first to admit that they are flawed, too: “If you believe models are going to be right, you’re going to be wrong.”

The question is whether BlackRock’s clients understand that they are not meant to rely on Aladdin’s prognostications for investing. BlackRock executives insist their models are designed to validate ideas that have been arrived at independently by clients rather than to generate them. That said, the company’s marketing materials talk of Aladdin’s services as a way to “see opportunities” in markets.

Mr Fink concedes the theoretical possibility of a herd mentality taking hold among users of Aladdin, but he is adamant that no such thing is happening in practice. “People can use our methodology or not,” he says. “Our models teach you the kerbs of the road, they don’t tell you the speed you should be travelling, or where the curves are in the road.” Most of what Aladdin does could be replicated in other systems like Bloomberg, he points out; Charles River, a consultancy, also provides very widely used analytic tools.

Half a dozen Aladdin users polled by The Economist, speaking on condition of anonymity, seemed to confirm this. They all said that they use BlackRock to supplement their own risk analysis, not as a substitute. “BlackRock’s analysis is one element our staff look at when we make investment decisions, but that doesn’t necessarily mean they guide us one way or another,” says a boss at a rival asset-management firm. Other factors are more likely to lead to groupthink in financial markets, he says. “My [staff] read The Economist, and the people they trade with read it too. That doesn’t make me nervous.”

BlackRock’s diverse product range is good for its shareholders (who have seen their shares rise over 40% so far this year), and its ETFs have saved investors billions of dollars in fees. The company is widely expected to keep growing, though it may face some difficulties. The performance of its actively managed funds, while broadly good, is patchier than its supposed informational advantage might suggest, and the larger this part of the business gets, the harder it becomes to beat the market. The ETFs, for their part, will look less alluring in equity markets less bullish than those of the past few years.

And BlackRock’s perpetually “neurotic” outlook still looks like something that would have served the world well in 2008, had it been wider spread. But one lesson of that crisis was that investors needed to do their own legwork. If models are always wrong, as BlackRock posits, it should perhaps be a little worried that so many people are using the ones it offers. Maybe it is a source of correlation Aladdin could be asked to look out for.

0 comments:

Publicar un comentario