Weekly COMEX Gold Inventories: Quiet Week But Far From Normal

Sep 22 2013, 02:37

In last week's report, we saw another quiet week in terms of COMEX gold inventories with registered inventories dropping slightly. This week's COMEX registered gold inventories showed a slight gain for the first time in over two months, but the total weekly change was pretty much unchanged.

Keeping track of COMEX inventories is something that is recommended for all serious investors who own physical gold and the gold ETFs (GLD, PHYS, and CEF) because any abnormal inventory declines may signify extraordinary events behind the scenes that would ultimately affect the gold price..

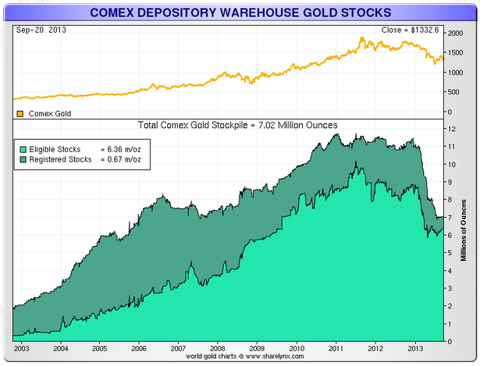

Source: http://www.sharelynx.com

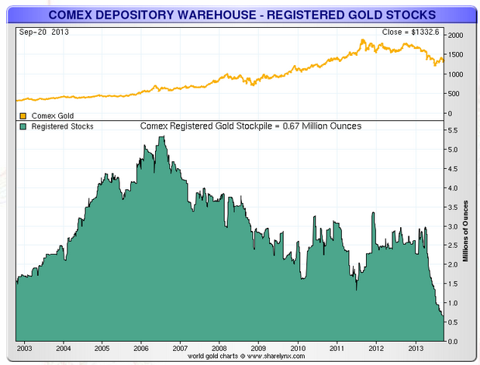

As you can see on the chart above, after the large decline in both registered and eligible gold stocks since the end of 2012, the last few weeks have shown some stabilization in gold inventories. We will take a closer look at these numbers but let us first explain the COMEX a little more for investors who are unfamiliar with it.

Introduction to COMEX Warehousing

COMEX is an exchange that offers metal warehousing and storage options for its clients. The list of their silver warehouses can be found here and their gold warehouses can be found here. In the case of silver and gold, the metal is stored at these official warehouses on behalf of banks and their clients and can be used to settle futures contracts, transferred between clients, or withdrawn from the warehouse. This offers large holders of precious metals a convenient way to store their metal with minimal storage fees - very convenient indeed if you hold large amounts of gold or silver and you don't want to store them in your basement.

Silver and gold stored in these warehouses can fall into two categories: Eligible and Registered.

Eligible metals are those that conform to the exchange's requirements of size (1000 ounce bars for silver and 100 ounce bars for gold), purity, and refined by an exchange approved refiner. Eligible metals are stored at COMEX warehouses on behalf of banks or private parties, but are not available for delivery for a futures contract.

Registered metals are similar to eligible metals except that these metals are also available for delivery to settle a futures contract. COMEX issues a daily report on gold, silver, copper, platinum, and palladium stocks, which lists all the metal that is currently stored in COMEX warehouses and how much eligible and registered metal is present.

This information allows investors insight into how much metal is currently backing COMEX futures contracts, what large gold and silver owners are doing with their metals, and how many clients are requesting delivery of their metals. There is a lot more to glean from this information, but for the purpose of this article we will focus on the gold drawdown.

This Week's Changes: First Weekly Increase in Registered Gold in Over Two Months

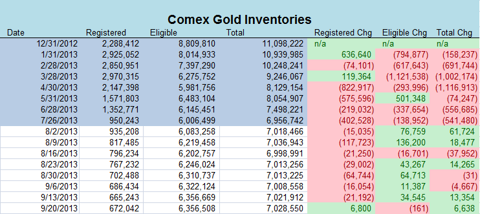

Let us now take a deeper look at the gold drawdowns being seen in the COMEX warehouses.

As investors can see in the table above, there has been a consistent decline in COMEX gold inventories since December. Last week we saw eligible stocks of COMEX gold decrease slightly by 161 ounces, while total COMEX gold stocks increased for a second straight week by a smallish 6,638 ounces.

Registered gold stocks increased for the first time in quite a while, but the increase was only 6,800 total gold ounces.

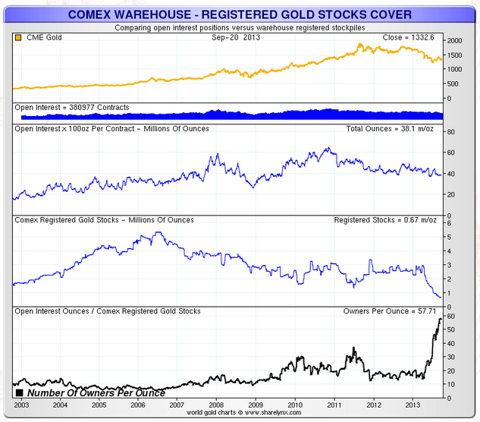

Finally, let us take a look at possibly the most important number when it comes to COMEX gold inventories - the registered gold cover ratio. We've discussed this in-depth in a previous article so please refer to that article for details, but in a nutshell it is the amount of investors owning a claim to each registered gold ounce (i.e. owners per registered gold ounce).

This ratio has been almost parabolic since April 2013, and continues to be at all-time highs registering 57.61 owners per registered gold ounce. Investors need to remember that all of these numbers need to be taken into consideration with each other - without knowing how many owners-per-ounce COMEX inventories will not be as helpful.

What does this Mean for Gold Investors

It seems that COMEX gold has stabilized a bit over the last month, but we would want to see inventories rising to higher levels or owners-per-ounce dropping back to more normal levels before we really start taking our eyes off of COMEX inventories.

Based on COMEX gold inventories, we still remain quite bullish on gold simply because we are at all-time low levels of registered gold and all-time high levels of owners-per-registered gold ounce. What it would take for COMEX gold inventories to be bearish for gold would be significant increases in registered gold (suggesting gold in plentiful) or a large drop in owners-per-ounce (which would suggest gold interest is fading). Neither of these things is currently being seen in COMEX gold, so COMEX gold remains fundamentally positive for gold.

We want to remind investors that COMEX inventories are just one factor when investors try to gauge gold supply and availability, so we could be bearish or bullish based on COMEX gold inventories but have the opposite overall stance towards gold (i.e. COMEX gold is bullish but we are bearish on gold because of other fundamentals). Right now, we believe that both COMEX gold and other gold fundamentals are still bullish - so we remain bullish on gold.

Therefore, we continue to recommend investors build positions in physical gold and the gold ETFs (GLD, CEF, and PHYS). In terms of the miners, they offer investors much more risks (and rewards) so investors interested in increasing their returns may want to consider miners such as Goldcorp (GG), Randgold (GOLD), Agnico-Eagle (AEM), the Market Vectors Gold Miners ETF (GDX), or any of the other gold miners. But as we always emphasize, buying gold miners includes many other risks that are not present with owning physical gold, so investors should make sure that they do their due diligence before investing in a particular miner.

COMEX gold inventories have been relatively boring over the last month, but they remain at historically low levels so investors shouldn't be fooled into thinking that stabilization equals normalization - we are far from normal. How this all plays out is anybody's guess, but for now COMEX gold remains worth following.

0 comments:

Publicar un comentario